In Startup50 2016: For already touching an AUM (Assets Under Management) of Rs. 200 crore and having Rs. 500 crore in forward-looking SIP commitments

Founders: Sanjiv Singhal, E R Ashok Kumar (In Pic)

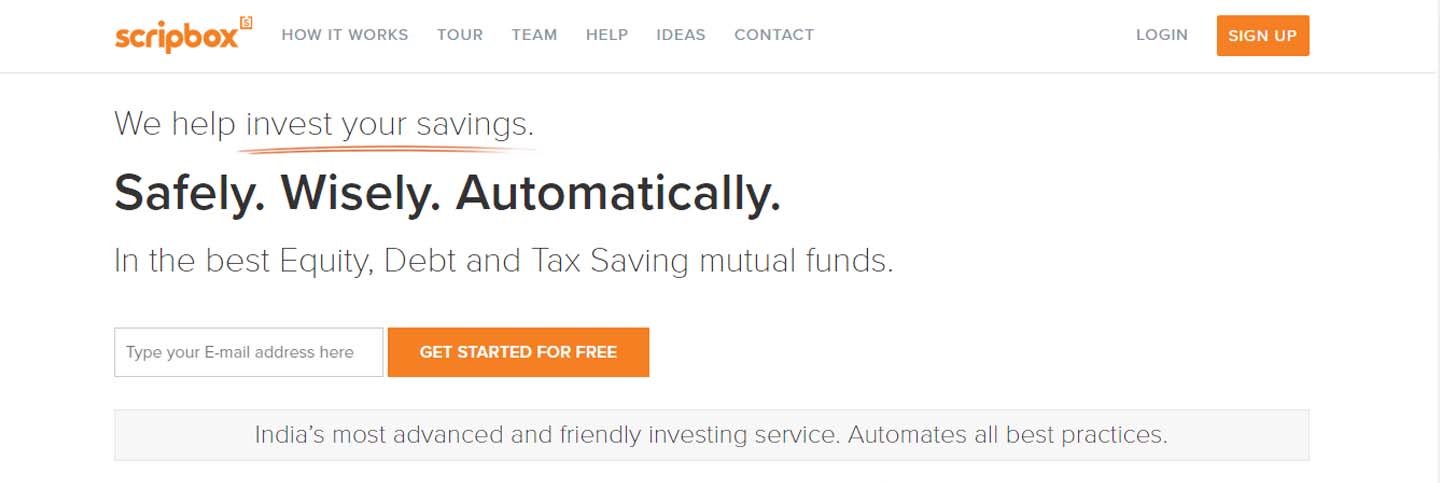

Scripbox is a friendly investment service for beginners and sophisticated investors alike. Its proprietary algorithm, which is fed with more than 200 algorithmic rules, narrows down over 8,000 mutual funds to just eight, thus helping individuals invest without confusing them with financial jargons; automates best practices; and helps them with actionable money skills.

Scripbox is a friendly investment service for beginners and sophisticated investors alike. Its proprietary algorithm, which is fed with more than 200 algorithmic rules, narrows down over 8,000 mutual funds to just eight, thus helping individuals invest without confusing them with financial jargons; automates best practices; and helps them with actionable money skills.

Funded across three rounds by Accel Partners, Omidyar Network and other angel investors, the company currently has one or more customers across 400 cities in India, and records a transaction a minute.

A Marked Difference

A key differentiator for Scripbox lies in targeting young investors rather than the traditional target audience. To make its investors financially sound and aware, it launched Money Skills, in collaboration with corporate entities, to educate their employees and help them to take care of their financial health. For example, in typical 45-minute sessions with young employees, Scripbox provides a holistic view on key concepts such as Inflation, compounding, understanding salary slip, and tax saving instruments. Thus far, over 70+ corporates have signed up and 5,000 employees have undergone this program in Bengaluru. A second initiative it rolled out was Wealth Check-Up, through which 5000 people answered questions on their savings and investments and 90 per cent showed poor financial health.

With its primary vision being to encourage youngsters to save wisely, through these and various other initiatives, Scripbox has written in stone a goal for itself; to create a million millionaires in India.

The Word Around

- Money Skills is an initiative launched in collaboration with corporate entities to educate their employees, through 45-minute sessions, about key financial & investment concepts

- Wealth Check-Up: An initiative launched for young investors to assess what they are doing right or wrong with their money

- Corporate Outreach: Held offline activities at IT parks & reached out to 25000 people