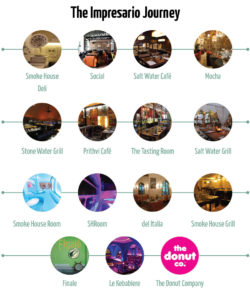

Over the last 16 years, Impresario’s Riyaaz Amlani has launched a series of restaurant brands and formats. Amlani’s forte has been his ability to spot emerging consumer trends and marry that with an exciting, fun, eating out experience. Amlani’s next bet is on what he calls the second wave of dining… Read on.

One could simply say, Riyaaz Amlani, of Smoke House Deli and Social Offline fame, has seen the night and day of restaurant businesses in India. When we spoke to him two years ago, he had put quite succinctly that his era of entrepreneurs would see Indians eat out more than 15 times a month. But ask him today what the industry is like, and he’ll prophesise immediately of a ‘second wave of dining’ setting in. So, what’s the second wave all about? “Around 1999, India saw a fine dining wave wherein the cream of the society was given access to quality food, whereas the upper middle class was still alien to such quality offerings. Then came casual dining and QSR, which made quality food accessible for the middle and the base segment (by offering affordable casual dining). Now, this segment wants to upgrade; and this we call the second wave,” he elaborates.

Riding the Wave

Having started out as a shoe retailer, Amlani set foot into the Indian restaurant business in 2001, with his low-margin, high volume café model, Mocha. The idea back then was quite simple; to create a place where people could spend quality time lounging around. Operating at an average cost per cover of Rs. 250, the outlets saw a table turnover of 4.5. Then, as the coffee space became too cluttered with multiple brands setting shop, he turned to fine dining with the high-margin, low-volume café model, Salt Water Café. However, this model, which operated on an average APC of Rs. 1,500 and a table turnover of one, soon saw closure because of a string of challenges on the leasing front. “We decided to shut this down and play the middle ground with Smoke House Grill in Greater Kailash, in Delhi, re-named as Stone Water Grill, in Pune,” he adds.

Amlani seems to have a knack of charming customers into his restaurants. During New Year’s, last year, he introduced the Rs. 31 ‘Mitron Shot’ wherein every time the Prime Minister, in his hour-long address, used the word ‘Mitron’, customers could claim a beer or shot at just Rs. 31

The Investment Climate

So far, Impresario has raised two rounds of funding; one in 2008, to the tune of Rs. 25 crore, from Beacon India Private Equity and the second in August 2011, of Rs. 40 crore, from Mirah Hospitality, the company behind brands like Khandani Rajdhani and Manchester United Café. During the same period, existing investor, Beacon India Private Equity, also upped its stake in the company by investing a further Rs. 8 crore.

In 2015, while Impresario was in talks to raise private equity funding, it didn’t happen because of reluctance from investors, especially in the F&B sector. “But with some restaurant chains filing to go public, we hope that the investor interest in this market will revive,” says Amlani.

Tackling Regulatory Battles

For this President of National Restaurant Association of India (NRAI), while the challenge earlier was in identifying prime real estate and retaining talent into the company, Amlani indicates that today the company has started looking at property on its own merit. “Earlier, restaurant businesses used to compete on two fronts; real estate, and labour. To tackle this, we’d entered into a collusive oligopoly model,” he indicates. For example, Impresario partnered with Mirah Hospitality to occupy big spaces at prime locations in India, thus securing a discount on the land rate, and in turn, setting up a range of eateries on the owner’s property. “Margins are anyway pressurised. So, earlier, it made sense for restaurant groups that complement each other, to work together. That way, the real-estate costs would come down, the labour market would be managed, and the overall input cost would reduce,” he says.

That being said, the challenge today, has however evolved to tackling overregulation in the industry. “There is a lack of clarity in regulations, they change State to State, and there is a lot of corruption too, in the industry,” he admits openly. The restaurateur believes that a lot of its margins get strained because of this and their growth is curtailed.

In the past two and a half years, while the restaurateur has setup 20 restaurants, his focus currently lies on his millennial brand, Social, a co-working space and bar now present as 16 outlets in three cities including Bengaluru, Mumbai and Delhi. “Social is particularly targeted at the young population which wants to eat out a lot but spend wisely on it,” adds he. His game plan for the chain is quite clear; he wants to expand the brand to 18 more outlets and enter three more cities; Kolkata, Pune and Chandigarh this year, taking the overall count to 40 in the next couple of years.