Narratives, anecdotes and insights from entrepreneurs at the helm of twenty food & beverage startups, each at different stages in the company building process.

For a layman to understand the growth India’s food and beverage market has seen in the recent past, all he/she needs to do is walk a mile, or walk through an aisle of a supermarket to observe the sheer number of new restaurants, cafes, bars and retail brands that have lodged in streets and store shelves. In more numeric terms, as numbers projected by the KPMG Report on India’s Food Service Industry show, the food service market in India stood at INR 3.1 trillion in 2016, a number that’s set to grow to INR 5 trillion by 2021.

From millennial-targeted casual dining cafes and craft beer alleys to healthy snack brands and organic farm products, the industry, touted as a sunrise sector, is seeing a kind of growth that seems to cater to the rising young population’s needs, their growing affordable incomes and of course, their changing lifestyles. Take the healthy snacks brand, Yoga Bar, for instance. Realising that today’s working population often tends to snack on unhealthy food during work or travel, the founders have launched healthy alternatives, like protein bars and snacks with natural ingredients like nuts, complex carbs and whole grains, to satisfy their food cravings. On the other hand, with fine dining taking a back seat and consumers from upper middle income segments too, seeking an affordable, yet upgraded dining experience, restaurateurs like Riyaaz Amlani (Impresario Foods) and AD Singh (Olive Bar & Kitchen) are experimenting with the Indian palate and ambience, by opening next-gen cafes like Social Offline, and spunk Iranian Cafes like Sodabottleopenerwala.

But, is it all an upward swing?

“Not really,” says Javed Murad, the founder of White Owl Brewery. Three years into the business, he recalls that among the biggest challenges he faced was in navigating through regulatory hurdles. “It’s not an intuitive learning but one that comes with experience. Added to this, there are a lot of laws in play when you’re setting up a factory (microbrewery),” he says. Amlani of Impresario Foods and Sumedh Singh Mandla of Grover Zampa Vineyards seem to share that sentiment. “Apart from a lack of regulatory support, each state in India has its own policy and several times, we decide to stay in a region based on viability with regards to functioning under set policy,” rues Mandla.

As we look deeper into these sub-sectors, we notice that the regulatory battle finds commonality not just with companies in the beer and restaurants market, but also with retail organic brands. For example, Seema Jindal-Jajodia, the founder of Nourish Organic Foods narrates the story of a regulatory hurdle that affects raw material sourcing for the company. “It’s fraught with challenges,” she says, and adds, “The local vendors prefer exporting raw material to other countries because their margins are higher. That means, we are forced to source material from outside too,” she rues. That being said, she hopes that the Government brings in some policies that would help producers of nuts and seeds (walnut, almonds, raisins etc.) supply profitably to the Indian market as well.

A second, more imminent challenge companies in this sector seem to face is the thinning investor interest in the industry. A classic example of this is Amlani’s venture Impresario Foods. Although the company has been trying to raise external investments from 2015, its founder points out that the lack of exits in the F&B space and the tendency of investors to go with the tide, makes it difficult for companies to raise investments. But, with a growing consumer class and smarter food entrepreneurs, there is hope that the best is yet to come.

The Other Side Of F&B Investments

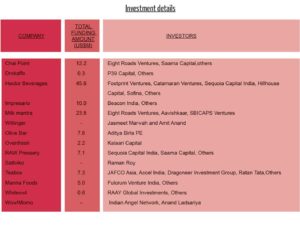

That being said, some other sub-sectors within F&B, such as beverages, fast food and QSR chains and retail products brands seem to have got their game right. A look at Venture Intelligence report for FY17 (Ref. Fig 1) reveals that while the sector has seen US $275 million being invested across 47 deals, the top three investments have been bagged by Azure Hospitality, Licious and Milk Mantra.

Amongst companies featured in this edition, the which attracted the maximum investment (from Venture Capital investors) in FY17 was Chai Point (US $12.2 million from Eight Roads Ventures, Saama Capital & Others). On the Private Equity front, in FY 16, Paperboat Beverages (Hector Beverages) raised Rs. 183 crore in funding led by Belgian investor Sofina and China’s Hillhouse Capital.

Creating Strong Differentiations

Despite its drawbacks on the regulatory and investment front, the overall sentiment seems to be that the opportunity in the sector is here for the taking, and this is what excited us most about F&B in India; that it’s no more about being your general next door neighbourhood outlet, but about getting deeper into understanding consumer nuances and building strongly differentiated products and spaces that cater to very specific needs. Keeping this in mind, our companies this edition span across the FMCG, Wine & Beer, Beverages, Fast Food & QSR, Packaged Foods and Internet-First restaurants. And, the companies featured include Nourish Organics, Milk Mantra, Dropkaffe, White Owl, Impresario Foods, Olive Bar & Kitchen, Manna Foods, The Bombay Canteen and Sattviko.

The idea behind featuring these companies is not to rank them but to understand how its founders perceive the sector, and how they tackle each and every sphere of the business; right from operations and finance, to marketing and supply chain.

The F&B20 Collection is sure to give you, our reader, multiple perspective of the opportunities that lie in India’s food & beverage sector. For us, the most exciting aspect, was how focused some of the entrepreneurs are. For Prasson Gupta of Saatviko, the opportunity revolved around the theme of Ayurveda. For Dropkaffe’s founders, the inspiration was new concepts like breakfast cereal smoothies and yogurt smoothies; while for the likes of The Bombay Canteen the differentiation revolved around thinking of food as a creation of art. Read on… to find out more.