To go aggressive on local manufacturing and bring hi-tech facilities into the country, OnePlus’ India GM believes the Make in India initiative needs to develop more policies focussed on driving cutting edge innovation and research

OnePlus, the Chinese smartphone brand which forayed into India a little over a year ago, took the market by storm when it recorded sales of over a million devices within its first year of operations. Riding on a lean and scalable business model, combined with back-to-back marketing campaigns, it created a resonating brand connect with the consumers in India in a short span of time. Today, around two years after founding, it has recorded a presence across 35 countries spread across Europe, North America and Asia. Specifically in India, in support of the present Government’s Make in India initiative, it has partnered with Foxconn to manufacture its OnePlus X devices locally (to suit the local needs), and play on price competitiveness as well.

While the company hasn’t yet directly invested in setting up local manufacturing facilities, it is gradually shifting production commitments to local factories. Currently, the phones are being produced at the 30,000 sq. ft. facility at Foxconn’s Rising Stars factory within the Sri City Integrated Business City in Andhra Pradesh. The facility has a peak capacity of producing up to 500,000 units per month, thus scalable to locally fulfil the demand for OnePlus smartphones in India in the future. The facility is also set to generate direct employment to over 1000 full-time workers, thereby giving further support to the Government’s Make in India initiative.

While a lot has been done, the government must relook at the structural drawbacks in fundamental reforms related to clarity on various tax, excise duty benefits, land acquisition, assured electricity and water supply and challenges posed by regional politics.

![]()

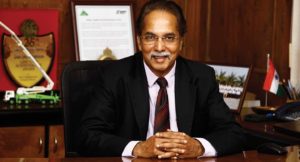

As the company plans to go aggressive on its service infrastructure to provide an enhanced sales experiences and scale up production, Vikas Agarwal, the India General Manager of OnePlus delves deeper into his views on the impact of the Make in India movement locally and in global markets.

The Impact of Make in India

In the last 14 months, the campaign has met with resounding success, with the government garnering investments worth US $3.05 billion from leading local and foreign companies. Fortunately, the timing is also opportune as most of the other markets are currently slowing down and facing internal challenges such as currency depreciations and cost escalations. Even in the current budget, the recent modifications related to customs and excise duty structure will play a vital role in providing a boost to the smartphone market. It will incentivise manufacturers to undertake actual manufacturing operations and not just leverage duty benefits through local assembling of SKD (semi knocked down) units, thus ensuring increased investment in the component industry, which will eventually lead to a native mobile component ecosystem in India.

Having said that, while the campaign is largely relevant for labour intensive industries, it would be better if the policies focused on driving cutting edge innovation and research as well. Because, a bulk of the value chain in technology industry lies in product IP and not in assembling or component processing. “Make in India should also leverage India’s huge talent pool and attract investment to set-up global R&D centres to generate employment opportunities for skilled labour, not just for unskilled and semi-skilled factory jobs,” he points out.

Addressing the Shortcomings

The current need of the hour, i.e. the key challenge is the lack of physical infrastructure and an ecosystem of component suppliers. Addressing this will require the Government to a relook at the structural drawbacks in fundamental reforms related to clarity on various tax, excise duty benefits and legal issues, land acquisition, assured electricity and water supply, regional politics, regulatory hurdles and more. The export incentives should also be clearly defined to attract global players to use India as a hub for their global operations, as the domestic market in India is currently not big enough to support large scale production facilities.

Even in terms of creating employment opportunities, since the land and labour laws in India are complicated, brands have so far stayed away from direct investments and instead relied on external partnerships to handle such local tasks. With such challenges in play, it is crucial for the Government to provide the necessary intervention to ensure long term success of the campaign.

At OnePlus, we feel, since India is currently at the early stages of manufacturing, it may not be best suited for large scale development of emerging technologies. Hence, we are currently focussed only on least value activities such as assembling, and will gradually move up the value chain to undertake development of hi-tech technology products as the ecosystem improves.

The Future

While different sectors are likely to grow at a different pace depending on individual sector dynamics and government incentives, technology is likely to be a big differentiator as it accounts for the largest foreign outflows after Oil. The Government has also recognised this and announced incentives to attract investments here. As a next step, it should follow it up with supporting reforms to continue to build on the initial momentum and gradually move up the value chain and not just attract low level assembling operations.

Given the stable government and improved investment outlook in the country, the manufacturing industry will change drastically over the next 10 to 12 years. With careful planning, we believe it is the right time for global manufacturers to build competitive advantage in India.