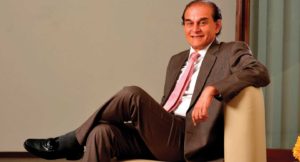

Dr. Ranjan Pai, Managing Director, Manipal Education and Medical Group, has led the professionalisation of the Group by consciously empowering his senior managers, seeding several new ideas and laying the platform to raise private equity capital for growth. Operating in two sunrise sectors – education and healthcare – he’s now gearing up to build tremendous scale in India and across the world.

Dr. Ranjan Pai belongs to the first family of Manipal, a small town located in the rocky hinterland of the Malabar Coast, overlooking the Arabian Sea. Manipal finds its place in the world map thanks to its status as India’s first university town, a position it owes to Ranjan Pai’s grandfather, Dr. T.M.A Pai.

For over five decades, Dr. T.M.A Pai and then his son Dr. Ramdas Pai ran and grew the Group’s various businesses, primarily hospitals and colleges. The core of the group, of course, was its value systems, clarity of value offered to students and patients and the goodwill it had with the local community.

Ranjan, Dr. Ramdas Pai’s son and a third generation entrepreneur, grew up in the environs of Manipal University. “Till I went to the U.S. for my Master’s in Hospital Administration, all I had in mind was that I would join my father after my studies and run the businesses in Manipal. The stint abroad opened up my mind,” says Ranjan about his early career.

In early 2000, Ranjan setup the corporate structure for the group by forming Manipal Education and Medical group (MEMG) in Bangalore. The idea at the time was to scale up in India and globally, for which the group had to bring in a set of professionals. Ranjan says, “The foundation of the group was very strong. But, to further build scale across the country, I had to bring in professional managers. It wasn’t easy to convince professionals to join a family business or, for that matter, match their salary levels. But, the move was crucial to build scale.”

I’d go to the extent of saying the purpose of education is to shape up people to become good well-rounded human beings. We want to teach people communication skills, life skills and enhance their attitude and approach to problem solving. I believe one should not confuse education and training. – Mohandas Pai on Education

![]()

Over the next few years, Ranjan thought big and executed bigger. He setup universities in Nepal, Malaysia, Dubai and Antigua, in addition to seeding and, then scaling, several educational services businesses in India.

On the healthcare front, more super-specialty hospitals were setup; a dental college was opened in Malaysia and the junior Pai also seeded two initiatives in the healthcare retail and stem cell research segments.

Over this period, MEMG expanded at break-neck pace. While there was no private equity raised at the holding company (MEMG) level, both the individual verticals (Manipal Global Education Services and Manipal Health Enterprises), raised money through the private equity route. Its investors included IDFC Private Equity (which has invested four times in Manipal Group since 2006 including 2 exits), Capital International, Azim Premji’s investment firm PremjiInvest and Narayana Murthy’s investment firm Catamaran. Overall, its group companies have raised capital from 10 private equity and strategic investors along with six successful (or satisfactory) exits so far.

Ranjan says, “In some sense, this is our investment philosophy. We start really small and put top quality management in place. We then put the Manipal brand in and bring in external capital for growth. Then we plan to sell, keep or IPO the business.”

Of course, all this is easier said than done.

This cover story highlights the finer nuances of how Ranjan ensured the successful execution of this plan to professionalise a five-decade-old family business and the various decisions that enabled the creation of a global education and healthcare Indian multinational.

The best aspect of Ranjan is that he doesn’t have a hang up for power. He’s brilliant at understanding the financial numbers and excellent at managing the boards. I look after governance. Overall, it is a partnership that is working brilliantly. – Mohandas Pai on his partnership with Ranjan Pai

![]()

Building its own family of professionals

In the early days of setting up MEMG, Ranjan’s primary role was to bring in a set of specialists and senior managers to manage the scaling up phase. Ranjan says, “If you look at universities at the time, they were typically managed by faculty members. But, once you start thinking big, it is crucial to bring in professionals who’ll, over time, have multiple institutions to manage. We met several extremely smart people but we always asked our selves, can we work with this guy? The cultural fit was always far more crucial.”

Since then, many senior managers, several of them from the IT industry, came on board. The most prominent of these included TV Mohandas Pai, the former member of the board and Head of HR of Infosys. Additionally, S. Vaitheeswaran, Swaminathan Dandapani (Swami) and Anand Sudarshan (who has since left Manipal Group) joined the group after long stints in the corporate sector.

Swami, who is currently the executive chairman of Manipal Health Enterprises, says the aspect that excited him about Manipal was the brand name it had with regards to its ethical values and the trust people had in its clinical practices. He says, “At Infosys BPO, I was fortunate to help extremely smart companies, ones that were constantly trying to become even smarter and I saw a huge opportunity to make a positive impact to healthcare delivery.”

Swami’s belief is that companies in several sectors, from FMCG to Banking, were becoming smarter and were transforming themselves with IT-enabled processes. He adds, “However, four sectors (in India) – health, education, agriculture and retail – have missed the bus and have been slow in this transformation journey. When the Manipal opportunity came, I grabbed it because it gave me the opportunity to bring in a technology oriented process-driven approach to healthcare operations enabling delivery of affordable and accessible healthcare to communities we serve.”

On the other hand, Mohandas Pai, who is currently the Non-Executive Chairman of Manipal Global Education Services, was not new to the Manipal story. He has known Ranjan and his father for years and joined the board of the Group about seven years back. Mohandas Pai says, “I really like Ranjan’s approach to scaling a business. He’s a true entrepreneur, one who seeds an idea, puts in a good management in place and goes into the background. I believe that it is a wonderful model of separating ownership and management that several companies in India must follow.”

Dr. Ramdas Pai has spearheaded Manipal Health for several decades. Today, he has stepped down and made me Chairman. The group, led by Ranjan from the front, really empowers its professionals to behave as entrepreneurs and it motivates people to join the company and potentially, build their careers in the Group. It is this approach that made me join the Manipal family once I was done with Infosys BPO. – Swaminathan Dandapani, Chairman, Manipal Health Enterprises

![]()

The education vertical

Over the next few years, MEMG is gearing up for growing its two mainstream businesses – education and healthcare. On the education front, the company operates several for-profit universities abroad and is looking to grow its educational services verticals in India.

To put things in perspective, Vaitheeswaran, MD and CEO, Manipal Global Education Services says, “Approximately, over 55 per cent of our revenues come from outside India.” The company opened its new campus in Dubai about 15 months back. Both the universities in Malaysia – an international university in Kuala Lumpur and a dental college in Malaca – and the medical college targeted at the U.S. students in Antigua, expanded capacity recently. Vaitheeswaran says, “One of my primary focus areas is to get more students through the doors of these global universities. The goal is to attract a high-quality, diversified talent pool.”

From an India-perspective, Vaitheeswaran wants to derisk against a complicated regulatory framework. The firm is launching a series of certification programs – spanning from 1-day workshops to 4-month courses – to help learners with career enhancement. “The important thing for us to do is to partner with industry leaders and to value add to the curriculum,” says Vaitheeswaran. In addition to such programs, the company also runs elaborate programs in partnership with corporates. The most popular among these is the ICICI-Manipal Academy (IMA) for Banking and Insurance that offers students an MBA in Banking & Finance through a combination of in-campus and online learning modules. Vaitheeswaran says, “We started this initiative thanks to ICICI Bank’s vision of getting Day 1/Hour 1-ready bankers. Today, several other banks endorse the initiative.” Manipal operates similar academies for several banks and, till date, the company trains over 6000 probationary officers in the banking industry.

The company also runs MeritTrac, an assessment company that Manipal Group initially invested in and later acquired. At a broader level, the company wants to tap the entire food chain of the learner. To be sure, the company believes that learners are not only students but also mid-career executives who’re looking to upgrade their skills. Vaitheeswaran says, “I believe the three critical success factors in this space include – establishing a long-term connect with our students through various platforms, be it social media, alumni groups or physical classrooms; offering flexible learning programs in sync with the Internet-powered world of today; and the ability to build scale and ramp up programs really fast.”

Mohandas Pai has set an ambitious target for Manipal over the next 5 to 10 years. He says, “In the near-term, we want to be among the top 10 per cent of the colleges in the respective countries. Globally, we want our institutions to be among the top 500. Realistically, this will take about 10 years. One needs to understand that change in the education space happens slowly, there is no point accelerating this change.”

Mohandas Pai’s vision for the education business goes beyond helping students find jobs and skilling them. He says, “I’d go to the extent of saying the purpose of education is to shape up people to become good well-rounded human beings. We want to teach people communication skills, life skills and enhance their attitude and approach to problem solving. I believe one should not confuse education and training.” The industry veteran also believes that its time our universities embrace flexible learning options. If people want to enroll in a combination of software engineering and music, universities should make this easy to join, opines Mohandas Pai.

At a sector level, he’s very hopeful of how Indian universities will shape up over the years. “If we can get 20 institutions from India into the top 200 global institutions, it’ll be wonderful for the country,” says Mohandas Pai.

The healthcare vertical

Like in its education vertical, MEMG wants to serve the entire value chain of the patient – from preventive care to rehabilitation through Manipal Health Enterprises (MHE). Over time, it also wants to get into home care and maybe, even retirement homes. Ranjan says, “In the early 1990s, we probably had only 1 or 2 business models in the healthcare sector – that of large hospitals and nursing homes. Today, we’re seeing day-care surgery hospitals, birthing centers and the like. From a fund-raising perspective, there is private equity available for various business models. The jury is out on some of these, but there is potential.”

In addition to hospitals, the Group also runs several medical education universities for doctors. It has made a start into the retail segment with “Manipal Clinics” (a neighborhood multi specialty format clinics) and is in the process of developing a home care delivery format, all focused on providing “Accessible” and “Affordable” healthcare.

MEMG has also seeded Stempeutics Research, a venture focused on conducting research in the area of stem cell therapy. “We’re looking at this from a long-term perspective. I believe this (stem cell therapy) is going to become a play for the big boys in the pharmaceutical industry. Here, we don’t even look at progress from a financial perspective. The idea is to conduct top-quality research out of India and make progress.”

Swami, Chairman of Manipal Health, says, “My mandate for Manipal Health is to lead Business Transformation and enhance the process-driven approach to operations. While I was at Infosys BPO, I coined this acronym called ‘GDP’, which stands for Growth, Differentiation and People. My primary goal is to enhance and build further on the strong fundamentals of these three aspects of the business.”

On the growth front, Swami wants to expand to a capacity of 8000 beds from 5000 beds, currently. Of these, around 1250 beds will come from the hospitals abroad and the company will expand using a combination of greenfield and acquisition-driven methods. It recently acquired a 72-bed hospital in Kuala Lumpur, Malaysia and another 200-bed hospital is under construction in the same city. “The kind of goodwill that Manipal has in different parts of the world is amazing particularly among the doctor community, thanks to our medical universities. Now, we’re piggybacking on the goodwill from the past in this growth and transformation phase,” says Swami.

The crucial elements of growing a healthcare business in India revolve around the ability to find enough talent (doctors, nurses and hospital administration staff, among others) and buying affordable real estate. As Swami says, “As I often repeat, affordability and accessibility are crucial in this segment. We will have to be innovative and come up with models using technology to expand the talent pool as also to reduce the reliance on brick and mortar locations. We’re looking at bringing in large doses of technology to enable this. Social Media, Cloud, Analytics and Mobility or SCAM as I like to expand it, are crucial elements of the operational process.”

The one thing that is probably never going to be a challenge for the healthcare sector is the size of the market. From urban areas to tier-2/tier-3 cities, the need for accessible and affordable healthcare is only growing. Swami says, “The biggest challenge for us will be to get our internal act together. When we go out to recruit talent, I tell our prospective hires that they can make a wonderful and a globally relevant ‘career for life’ in healthcare, with a clearly defined career path, in this industry.”

Swami is now gearing up to spearhead the growth of Manipal into a national player. “We’re currently well-known in the South and in Goa. Over the next few years, we’ll have a significant presence in places in North, West and Eastern India as well. On the international front, the focus market geographies are in Africa, Middle East and ASEAN,” says Swami.

The company is also looking at building a chain of neighborhood clinics, the first two of which are already operational in Bengaluru. Recently, the company worked with a partner organisation in Nigeria to setup a clinic there. It is also looking to establish a clinic in an upmarket area in KL.

From a management perspective, Swami applauds the Pais for their willingness to separate ownership and management. He says, “Dr. Ramdas Pai has spearheaded Manipal Health for several decades. Today, he has stepped down and made me Chairman. The group, led by Ranjan from the front, really empowers its professionals to behave as entrepreneurs and it motivates people to join the company and potentially, build their careers in the Group. It is this approach that made me join the Manipal family once I was done with Infosys BPO,” says Swami.

Understanding Ranjan

When asked about a typical day in his life at work, Ranjan says, “The good thing is it is never boring. With so many different kinds of businesses, the problems that crop up are so varied.” He is known to make his decisions quickly and is willing to live by his mistakes. Ranjan attributes his style of management to the early mentorship he received from his father. “I had the complete freedom to make my decisions – the good ones and bad.” Going forward, his idea is to make sure that the group gets the right CEOs, especially those with a pragmatic view. “We let them choose their own team and make their own decisions,” he adds.

From a corporate governance perspective, Ranjan has made sure that the extra effort is taken internally to get the right governance structure. “It really helps when we try to raise private equity,” explains Ranjan.

One of the toughest decisions for Ranjan is to let go of people. Another challenge for him, especially operating in regulated sectors like health and education, is to work around the regulations. However, he believes that it is crucial to stick to one’s core beliefs of not taking the short cuts. “Sometimes, the pressure to grow because of raising external capital can push you to take just one short cut. But it very important to say no, and stick to your ethical practices every single time,” says he.

Mohandas Pai is all praise for Ranjan’s approach to organisation building. He says, “I wish many more companies in India would separate ownership and management and empower their professional managers to do the job.” When Mohandas Pai announced that he was leaving Infosys, Ranjan invited him to join the Group. On the partnership between the two of them, Mohandas Pai says, “We get along really well, yet we’re very different people. He’s cool, calm and does not show stress. I am rather less patient, so to speak. When we have an argument, we have a brilliant method to resolve differences. I react. He doesn’t react and the next day everything is fine! On a more serious note, the best aspect of Ranjan is that he doesn’t have a hang up for power. He’s brilliant at understanding the financial numbers and excellent at managing the boards. I look after governance. Overall, it is a partnership that is working brilliantly.”

When he is not working on MEMG, Ranjan evaluates investment opportunities for his various investment vehicles including Aarin Capital. Prior to formalising the structure for his investment vehicles, Ranjan had made investments in companies like TutorVista (which he exited to Pearson) and MeritTrac (which is owned by Manipal today). Once Mohandas Pai joined the Group, they decided to team up and formalise the structure of Aarin Capital. Deepak Natraj, a seasoned finance professional, came on board to lead the fund. Till date, the fund has invested in 9 startups, most of them in education and healthcare. Aarin Capital has also invested in other funds including Zodius and Unitus Seed Fund.

“At the end of the day, for me the biggest joy comes from converting an idea into a business that has a future. The fund allows us to seed several ideas, many more than what we could do within MEMG. The fund does not have any external capital and Mohan and I are the only investors in it. Let us see how it goes,” says Ranjan, as he wraps up.

Dr. Ranjan Pai’s 10-point strategy to scale up Manipal Education and Medical Group (MEMG)

Created the corporate structure for MEMG and brought in several senior management professionals

Consciously empowered his CEOs and separated ownership from management

Built on the strong foundation created by Dr. Ramdas Pai and continued to focus on healthcare and education

Expanding globally was critical part of the growth strategy mix

Within India, the plan was to expand nationally

Laid the platform with sound corporate governance to raise private equity and importantly, ensure there was clarity in terms of giving them exits

Diversified business models to serve the entire value chain of the patient (healthcare business) as well as the learner (education business)

Preserving the core of Manipal Group, his father and grandfather even as the venture scaled up. No shortcuts was a strong policy across the board

Setup an organized fund – Aarin Capital – to pursue other investment opportunities

No private equity at the MEMG level. All PE investments were raised at the company level.

LEARNING & UNLEARNING

SWAMINATHAN DANDAPANI (SWAMI), EXECUTIVE CHAIRMAN, MANIPAL HEALTH ENTERPRISES, ON THE KEY LEARNINGS HE BROUGHT INTO THE HEALTHCARE INDUSTRY FROM HIS PREVIOUS AVATAR IN THE IT-ENABLED SERVICES SECTOR.

My biggest learning from my last years is the PSPD Model (profitability, scalability, predictability and derisking) that Mr. Murthy evangelizes so well and one that I used to follow at Infosys. At Infosys, I probably made the maximum number of acquisitions, and each and every time we used to tick of questions in the PSPD boxes to make sure we were making the right call. As soon as I joined Manipal, I started evangelizing this model here.

I wouldn’t call it unlearning, but the one aspect that is new for me at Manipal Health is the wide variety of people I interact with on a daily basis. We deal with a whole lot of extra ordinary doctors, young and old age patients, hospital administration professionals and several others. In some sense, working with these people is very different from working with people in the IT-enabled BPO industry where the average age of my team was probably 28. Working with youngsters one can experiment with new ideas, they are receptive to change etc. In a more mature environment the challenge of change is harder and one has to really be a “GURU” to make an impact.

S. VAITHEESWARAN, MD AND CEO, MANIPAL GLOBAL EDUCATION SERVICES, ON THE KEY LEARNINGS HE BROUGHT INTO THE HEALTHCARE INDUSTRY FROM HIS PREVIOUS AVATAR AT INFOSYS AND EICHER MOTORS.

Prior to Infy, I worked in the manufacturing sector where you could safely say your product’s quality is top class if it passed a series of tests that measured some key metrics. But at Infy we realized that your offering is only as good as what your client perceives it to be. Now, adapting that to the education industry, I believe that we’ve done our jobs only if we value add from a student perspective. The other aspect that Infy was really good at was process-driven decision making. The ability to follow a rigour set of processes and systems is something we’re trying to adapt to the education sector now.

On the other hand, the under pinnings of almost everything we did at Infosys BPO was labour arbitrage. The impact we have on a learner or a student here is much more than we have on the client. At the age of 19, students come join your university for four years and it is crucial that we offer them the education with responsibility and care. This to me is the biggest area of focus at Manipal Education.

DEEPAK NATRAJ, MANAGING DIRECTOR, AARIN CAPITAL, DISCUSSES THE INCEPTION AND INVESTMENT PHILOSOPHY OF THE FUND

Early stages

Apart from working actively on 3 or 4 group companies, Ranjan had intermittently made several investments as a part-time investor. I came on board in July 2010 to help with strategic initiatives at MEMG with a focus on investments. Over time, due to Ranjan and Mohan’s (TV Mohandas Pai) passion for investing in and working with entrepreneurs, we decided to formalize our investment activities by creating a fund.

One of the calls we made early on was that we wouldn’t have any external limited partners, primarily to allow us maximum flexibility for learning and experimentation of our approach. Ranjan has built businesses from scratch, raised both debt and equity from private investors and overall understands managing investors’ interests. This added capability greatly improves Aarin’s ability to help founders succeed.

Investments made

Thanks to the Manipal background, education and healthcare become natural focus areas. The background helps us evaluate deals on the ground (for example, checking with doctors on the potential of a new medical technology), open up our connections to an investee company (one of our investee company’s mobile based education product is now being used and tested at the Manipal School network) and simply use our experience in these sectors to advise the entrepreneur as best possible.

We’ve directly invested in several start-ups. In med-tech, we’ve invested in implantable medical devices, mobile health and genetic testing. In the education space, we’ve invested in the test preparation space, a start-up that does active tutoring using tablets and in a blended MOOC (massively open on-line course). In healthcare, we have supported ideas for creating biologic products using nano-medicine and platform technologies. Some of our investees are still in the stealth mode and hence have not been mentioned here.

We have also made seed/anchor investments in several funds including Zodius led by Neeraj Bhargava (formerly with WNS), Unitus Seed Fund, a fund focused on BoP start-ups, a cloud, analytics, social and mobile technologies-focused fund called Tandem Habit III run by Sunil Bhargava and Rohit Bhagat based out of the Valley and ExFinity a fund promoted by senior members of the Indian IT services industry aimed at supporting tech entrepreneurs build out new ideas. The purpose is to expand our presence in the ecosystem by collaborating to gain access to specific skills that we do not entirely have.

Deal evaluation

The one additional item (apart from team, idea, space etc.) that we evaluate is as to whether the entrepreneur has asked all the right questions about his business. He need not necessarily himself have all the right answers on solving a problem, but is he asking the right set of questions?

In the case of many of the ideas we hear, there is a déjà vu moment when we feel we’ve probably heard it somewhere before but perhaps in a different context. However, the differentiation, as is often repeated, remains in the success of execution. We, nevertheless, believe that starting by asking the right questions about the problem to solve can go a long way in ensuring success.