Here’s a fictional conversation we play out:

“We’ve reached 20 million USD in annual revenue. Our EBITDA margin stands at over 20%. I am ready for an exit. What multiple will I get, if a Big 5 IT services company acquires us?” says the founder of an analytics services firm.

“It depends. And, are you sure someone would want to acquire you?” responds a Board Member adding a perspective that an exit is not a given.

“Why? We have gotten the revenues. We have the customers. We have a wonderful team in place.” – Founder

“You need to look at it from the acquirer’s perspective. Are you the best company to acquire in this space? How predictable are the financial projections? Is integration going to be easy? Does your company have the execution rigor that’ll continue without the founder? And, a lot more factors at play.” – Board Advisor

While the specific conversation above is fictional, similar conversations are happening across mid-tier IT and technology services companies in India. The important question to ask here is – how do we get a company ready for an exit or growth capital? The key is to plan for it ahead of time.

For this post, we decided to have a conversation with Radha Rani, Founder and Managing Partner of Surge Advisors, a firm that is focused on helping entrepreneurs and mid-sized companies raise growth capital, support M&A, and catalyze growth through strategic advisory.

Radha is well-positioned to answer this question considering she has spent decades in the IT services industry in a range of roles – spearheading successful fund-raises and acquisitions. Before starting Surge Advisors, Radha was at Mphasis, where she led and concluded acquisitions and divestitures including India’s $1bn+, one of the largest-ever PE buy-out to one of the largest global PE firms.

What is the overall landscape looking like, especially for technology services companies?

The Indian technology market is entering an exciting phase. The ambitions of founders are growing and global. Large companies – both domestic and global – are being built, on the back of two strong cycles of venture funding. Leading tech and service companies across sectors are seeing India as a growing market and they are looking at domestic acquisition to drive their India story. With pressures of exits growing and opportunities for consolidation emerging, we are bound to see increased deal activity through M&A, early signs of which are already visible.

The question is: As founder(s), what can you do to set up the company for an exit or large fund-raise?

So, what does it take for a company to get acquired or get on a growth trajectory?

Maximizing outcomes is the desire of most Founders who are looking to sell their business. Founders can take a pro-active approach or a very passive approach and each of these has an impact on the desired deal outcomes.

At Surge Advisors, we engage with Founders early on in the process and make sure they are ready. We want to help them tackle the next phase of their company – either faster scale through growth capital or exit through M&A – with minimal risk and a greater probability of achieving their desired outcome.

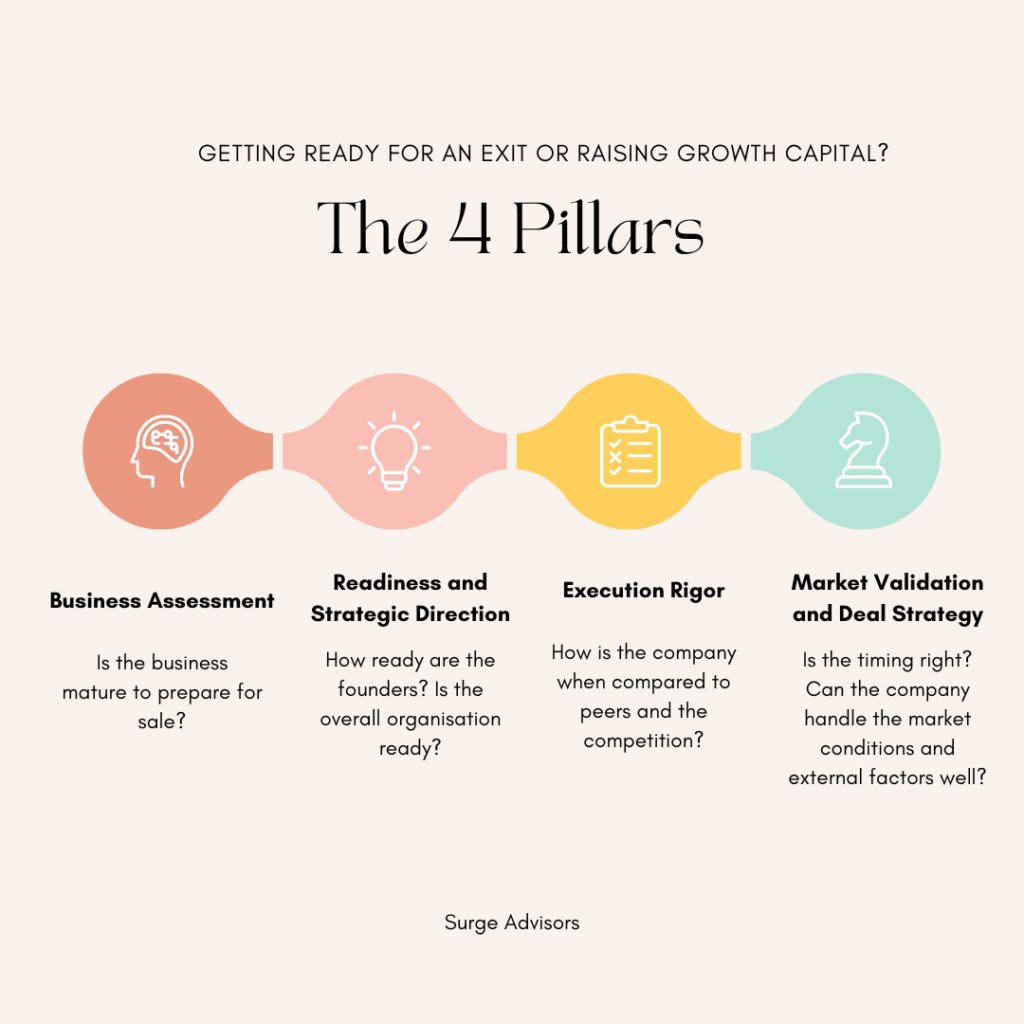

4 Key pillars (usually implemented in phases) for success include the following:

Business Assessment: All companies may not be ready today to command a premium value. It is important to assess the business performance and maturity to prepare for sale. This needs an in-depth assessment of financial & operations performance, client stickiness, competitive positioning, market opportunity, systems and governance.

Readiness and Strategic Direction: Founders often underestimate the most important factor that drives success – the Founders’ readiness and the businesses’ readiness. This requires intense effort to prepare and articulate the strategic objectives, goals, and metrics as it determines the deal value and outcomes.

Execution Rigor: Most companies may require a lead time to position their business to command a premium value. Favorable attributes and metrics such as a strong growth track record, its relation to peers, achievable financial projections that outpace the peers, product differentiation, and business tech innovation are imperative to unlock value. Because selling at a premium value is often attributable to some of these factors.

Market Validation and Deal Strategy: Timing is key, while companies may not be able to control the macro trends – it can proactively position the business to mitigate the downward pressure through strong performance. Given the lead time to build favorable factors and attributes, the Founders can substantially influence the deal outcomes. Needless to say, a strategic sale conducted when all factors are optimal will yield the best outcomes. However, when strong performance and synergies with buyers are well articulated – it becomes easier to command higher premiums even in tough market conditions.

How does Surge Advisors help its clients as companies/founders gear up for the next phase of growth and/or exit?

Surge Advisors’ mission is to achieve best outcomes for our clients by building a trusted relationship through our unique blend of strategy, execution, technology and transaction experience along with high level of integrity.

We believe the mid-market segment is underserved and needs strategic advisors to catalyse growth and scale to the next trajectory.

Surge Advisors partners with clients using our STRIDE Program & Classic Deal Execution.

STRIDE Program (short for ‘Strategic Direction and Execution’) involves 4 key pillars mentioned above. Following this, we support the Client with Deal Execution lifecycle from preparing the Information Memorandum, Investor Outreach to Deal Closure until execution of the Binding Offer/SPA.

Key Takeaways

- Overall, the journey towards to raising growth capital or planning for an exit (company sales) is a 12-18 month journey that must be planned with clarity.

- As a first step, the founders and leadership team must analyze the business from four perspectives:

- Business Assessment: Financial, Operational, and Competitive Positioning

- Strategic Direction

- Readiness for growth capital or exit

- Execution Rigour

If you’d like to partner with Surge Advisors in this journey ahead, give us a shout and we’ll connect you with the team.

Entrepreneurship Surge Advisors Investment Bank