Dr. Velumani helps us see what it takes to build a successful business in India; stamina and frugality. Clearly, investors loved these traits of Thyrocare and as a result, the IPO was oversubscribed 73 times. Through this article, the scientist-turned-entrepreneur helps us understand his professional journey, especially during the all important pre-IPO phase.

Once upon a time, Velumani was a son of a landless farmer in a small village called Appanickenpatti Padur in Tamil Nadu.

A little later in life, he was a graduate with no job, and wherever he went for an interview, the interviewer would say, “come back after gaining some work experience.”

When he eventually found a job as a shift chemist at Gemini Capsules, a small pharmaceutical company in Coimbatore, he earned Rs. 150 per month, in the late 1970s. As luck would have it, the company shutdown after a few years and Velumani had to look for a job again. He, then, joined Bhabha Atomic Research Centre (BARC) as a lab assistant and pursued a PhD. while he still worked.

A product that is different, a market that is elastic, a business that is fairly recession proof, ability to deliver as per profitability and growth expectations of investors, and most importantly, a good leader at the helm, are crucial. One needs to understand that investors easily see through, if there is anything less. Similarly, if you’ve a sound business, word of mouth spreads within the investor community and you do well. It is as simple as that

This phase of his life had a profound impact on how he runs his business today. “When people told me to get some experience and come back, I was hurt. I fantasized the creation of a company that would hire freshers, train them and give them an opportunity,” admits Velumani.

Of course, today, as of June 14, 2016, Dr. Arokiyaswamy Velumani is worth a whopping US $307 million, holding a stake of 64 per cent in Thyrocare Technologies, whose market capitalisation stands at Rs. 3,240 crore. And, in line with his earlier dream, Velumani has built his business with the support of his 750 employees, 98 per cent of whom are freshers.

Velumani, who a holds a PhD. In Thyroid Biochemistry, simply says, “I am thrilled we did a good IPO and delivered wonderful returns to our private equity investors who exited. But, today, I am back to running the business. I want to consistently grow at a CAGR of over 25 per cent, and that is what keeps me going.”

People close to Velumani – investors, senior employees and even vendors – had shared in earlier interviews with The Smart CEO about his laser-like focus on the business with no distractions. In fact, one of his senior team members at the Thyrocare Lab in Navi Mumbai tells me, “For Sir, work is life. He lives in the laboratory, and he’s thinking about the business all the time.”

I prod further to find out that it is literally true. Velumani has built a home for himself and his family, in the same floor as his corporate office, stones throw away from Thyrocare’s fully-automated Central Processing Lab (CPL) in Navi Mumbai and is seen walking around the lab even in the middle of the night.

Countdown to a successful IPO

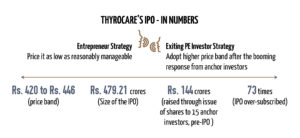

I sat down with Velumani for a chat, a month after his successful IPO, which was oversubscribed 73 times. Specifically, I wanted get a glimpse of the events that unfolded from the time the organisation got the SEBI approval to the day of listing.

Velumani admits that from a promoter perspective, the pre-IPO period of about 150 to 200 days is an exciting, unique experience. “You meet a ton of new people – merchant bankers, legal teams, people at the helm of stock exchanges and, of course, SEBI. It is almost like a wedding – so many new agencies involved, for a very important day of your life.”

For Thyrocare, the IPO was the route to give its private equity investors an exit. “I was lucky to get my firm listed at no cost to the company; all the expenditure was borne by the PE investors who were exiting the business,” says the scientist-turned-entrepreneur with a hearty laugh, emphasizing on how he continues to be frugal in the way he runs the business.

Velumani believes the fundamental requisite to ensure a good IPO is to simply have a great business with a sound DNA. According to him, “A product that is different, a market that is elastic, a business that is fairly recession proof, ability to deliver as per profitability and growth expectations of investors, and most importantly, a good leader at the helm, are crucial.” And all this has an impact on how an investor perceives your business. He opines that, “Investors can easily see through all this if there is anything less. Similarly, if you’ve a sound business, word-of-mouth spreads within the investor community and you do well. It is as simple as that,” explains Velumani, almost making it sound easy.

Through the interview, I notice that he has a very simple approach to thinking through business aspects. One of his greatest strengths, I am told by one of his team members, is clarity of thought. “He makes a decision and simply goes ahead and executes it. Often times, this decision may be contrary to the popular opinion at the time, but at Thyrocare, it has worked.”

I ask him about timing the IPO right and he shoots right back: “It cannot be timed. There are unsuccessful IPOs in good times and stellar IPOs during bad.” However, he did not waste a moment after Thyrocare received SEBI approval for an IPO. Edelweiss Financial Services Ltd, ICICI Securities Ltd and JM Financial Ltd were hired to manage the IPO, and Thyrocare’s private equity investors – CX Partners which held 27 per cent and Norwest Venture Partners (NVP) which held 10 per cent – spearheaded the process along with the promoter group.

Velumani says, “One of my philosophies is to just get things done. There is no point announcing several years ahead of time that your vision is to get listed. When the time is right, you just follow the process and work towards an IPO. I’ve seen so many companies announcing their IPO intentions, only to never see it come through.”

One of the most important decisions to be made pre-IPO, is deciding the price-band and hence, setting a valuation expectation. “I believe I am king when it comes to pricing. My business itself is built around the ability to price our services right as I follow a basic philosophy – price it as low as reasonably manageable.” Eventually, Thyrocare fixed a price band of Rs. 420 to Rs. 446 per share, with the goal of raising Rs. 479.21 crore at the upper end of the price band. Velumani reveals that while he suggested a lower price band, his investors wanted to price it much higher, after seeing the response from anchor investors. Thyrocare raised Rs. 144 crore through the issue of shares to 15 anchor investors.

The entrepreneur recalls that he did almost 150 meetings as part of the roadshow in about 30 days. “Overall, it was really satisfying and the feedback we got from prospective investors was very motivating. I must add, though, I probably sounded like a broken cassette player at times,” he says tongue-in-cheek.

For three days starting April 27, 2016, Velumani was glued to his computer. In his own words, he was like a politician checking the latest count during election results every few minutes. On day-one, the issue was subscribed 56% and was 2.25 times oversubscribed on day-two. “At that time, my merchant banker told me, expect to be at least 10 times over-subscribed on day-three. By about 3PM, Thyrocare was 37 times over-subscribed, a number that was important to me as that is what Dr. Lal PathLabs hit,” says the competitor in Velumani. By 4 PM, the number was 73 times over-subscribed, meaning institutional investors bid for 73 times the number of shares earmarked for them.

Amidst the celebratory mood, at 9 PM or so, Velumani received an e-mail. Kotak Mahindra Bank had moved the court after its share application was rejected because of a technical glitch. “Three days or so after the IPO, we received summons from the High Court, to show up for a same day hearing. Kotak had moved to stay the IPO, if their issue was not accepted. It was a nightmare of sorts,” recalls Velumani.

Thyrocare’s merchant bankers roped in law firm, Khaitan & Co, to represent them and resolve the issue. Thankfully for Velumani and Thyrocare, the issue was resolved amicably and Kotak Mahindra was allowed to participate in the IPO.

Several analysts believed it was Thyrocare’s sound financials and a robust business model that ensured a successful IPO. Thyrocare’s competitor, Dr. Lal PathLabs, also had a successful listing in December 2015, when shares rose nearly 50 per cent on day of listing. Investors bet on the market potential of a diagnostics chain to capture a large chunk of a market, which till today is largely unorganized and fragmented. This listing served as a benchmark of sorts for the Thyrocare IPO.

Thyrocare is a high margin, low capex business. On the other hand, this one is high capex, lower profit. Maybe, we’re a little early to the market. We also need to figure out ways to make it truly affordable – on foraying into the oncology diagnostics space with the launch of nueclear healthcare

The Thyrocare Business Model

At the very heart of Thyrocare’s business model is a low cost, low price model. “I am firm believer in taking less money from a customer,” says Velumani. But Thyrocare’s business model goes beyond this.

The company works with over 1,122 authorized service providers (ASPs), with whom it has a franchise agreement. The cheapest test package offered by Thyrocare, branded ‘mini Aarogyam’, is offered to the franchise partners at Rs. 400 and includes 33 tests. The franchise partner pays Thyrocare Rs. 400, and he’s free to price it for the end consumer adding a margin and most franchises sell it at Rs. 600. Of course, there is the upper price band, which the ASPs have to adhere to.

The ASPs collect samples from local laboratories, walk-in customers, referral doctors and home collection services and sends it to the Central Processing Lab (CPL) in Navi Mumbai or to one of the Regional Processing Labs (RPLs) in New Delhi, Coimbatore, Hyderabad, Kolkata and Bhopal.

CPL is fully-automated with a state of the art Siemens Aptio Automation Solution. In fact, it is the largest lab automation track, setup anywhere in the world. RPLs do not have the capability to manage all tests, but is crucial for Thyrocare’s scaling up plans into untapped districts. Velumani says, “The vision is to setup 25 regional processing facilities across India, to expand our geographical reach.”

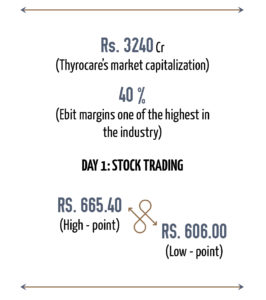

But the most interesting aspect of the lab comes from the financial model. Thyrocare does not take on the CapEx to setup the lab. Instead, it has established a long-standing partnership with Siemens to pay for reagents on an OpEx model, versus taking on high capital expenditure. Siemens is also responsible for maintaining the lab and Thyrocare with its high volumes is able to command such a partnership. Velumani emphasizes that low price also means low cost and it cannot come at the expense of margins. The company, today, operates at margins of close to 40 per cent, thanks to this ability to get a good working model with vendors, automation and efficient operations.

Velumani is passionate about financial discipline and says frugality must be at the center of any operation. “That and stamina, are, according to me, the two ingredients of a smart CEO,” he says, taking a dig at our brand. Over the twenty years he’s been in business, he’s never taken on debt and thrives in his ability to run a business with negative working capital. “We found a model where the customer pays cash, way before a sample is sent for processing.” Of course, high volumes are crucial to his vision of growing at a CAGR of 25 per cent year of year. “I am sure you’ve heard us on radio, off late. We’re certainly increasing our decibel level on the marketing front,” he says.

Diversifying into cancer diagnostics

Velumani forayed into the oncology diagnostics space, with the launch of Nueclear Healthcare. The vision is to deliver PET-CT fusion imaging at low costs to cancer patients. However, Velumani admits that he’s going slow with respect to this business. “Thyrocare is a high margin, low capex business. On the other hand, this one is high on capex and lower in profit. Maybe, we’re a little early to the market. We also need to figure out ways to make it truly affordable or per capita income has to grow,” he explains.

For now, though, from a growth perspective, Velumani continues to bet on Thyrocare and plans to adopt the waiting game with Nueclear Healthcare.

Financially speaking

From a numbers perspective, Thyrocare touched Rs. 240.9 crore in annual revenue in FY 2016, up from Rs. 182.9 crore in FY 2015. The company’s profits from operations was Rs. 75.2 crore up from Rs. 59.5 crore the previous year. In the Thyrocare business (excluding Nueclear), its EBIT margins is close to 40 per cent, one of the highest in the industry. Velumani adds, “I’ve no problems in sacrificing EBIT a little bit, to ensure my CAGR continues to be around 25 per cent. But, it is crucial to continue to work on cost efficiencies, as the brand scales up.

In terms of marketing, the company is moving towards radio and digital advertising, considering that its target audience is largely on digital media.

From a product perspective, Thyrocare believes over 75 per cent of its revenue will come from Aarogyam, its preventive healthcare test brand. At a broad level, its test menu spans three categories – thyroid tests, non-thyroid tests and preventive tests.

However, Velumani has a unique approach to advertising. The jingle on radio reads, ‘Think Thyroid, think Thyrocare.” But surprisingly, only 10 per cent of the company’s revenue comes from Thyroid. Velumani gives an explanation: “We market the thyroid tests. But once a customer comes in, we give him the Aarogyam range of tests at almost the same price, so he or she takes the Aarogyam package. It has worked for us and we’re amplifying the same.”

On a parting note

On May 9, 2016, its first day of trading, the stock hit a high of Rs. 665.40 and a low of Rs. 606.00. Today, Thyrocare’s market capitalization stands at Rs. 3240 crores and the stock currently trades at Rs. 605.9 (as of June 15, 2016).

For Velumani, the journey at Thyrocare is not just business. “I started this journey 20 years back with my wife, Sumathi. It is what I live for,” he says. As we draw this conversation to a close, he reveals that his wife was his first employee, first partner, first mentor. “The day I told her, I wanted to quit my job and start something, she said, I want to quit my job too.”

With a net worth of over US $300 million, Velumani is certainly a satisfied man today. But he has one big regret. He lost his wife and business partner, Sumathi, to cancer in February earlier this year. “About 70 days after I lost her, our IPO was over-subscribed over 70 times. I wish she had been there with me,” he wraps up.