Leveraging on the strength of its existing network, V-Guard Industries aims to get a strong foothold in the non-south markets and grow at a CAGR of 20 per cent to 25 per cent in the next five years

POORNIMA KAVLEKAR

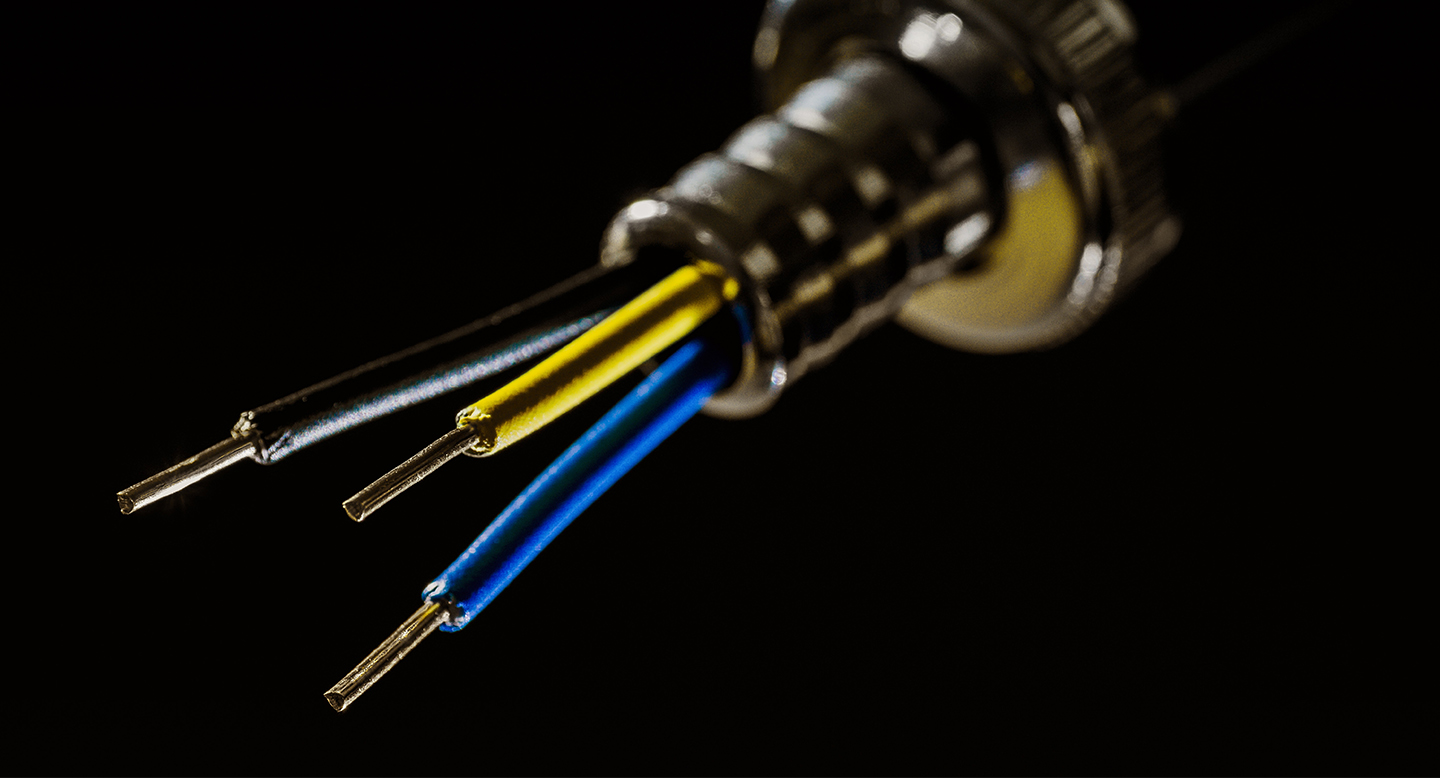

When the 32-year-old Mithun Chittilappilly took over as the MD of V-Guard Industries Ltd. (V-Guard) in April 2012, his mission was to ensure that the company continues its growth journey and accelerates momentum to further its course. Incorporated in 1977 by his father, Kochouseph Chittilapilly, to manufacture and market voltage stabilizers, V-Guard has since then diversified to become a multi-product company catering to the light electricals sector by manufacturing voltage stabilizers, invertors and digital UPS systems, pumps, house wiring/LT cables, electric water heaters, fans, solar water heaters and has also recently forayed into induction cooktops and switchgears. “It has been a long journey, from becoming Kerala’s most trusted brand to enjoying top recall across all the southern markets of India,” beams Chittilappilly. Now, as the company has begun distributing its products pan-India, Chittilappilly’s endeavour is to translate the trust that exists in the southern market, across the country. “This would be my primary mandate right now,” he adds.

Growth phase

The company’s turnover has grown by three times from Rs. 450 crore in FY10 to Rs. 1,350 crore in FY13 largely due to the sales from new markets outside south India. The southern states contribute around 75 per cent of the total revenue while the non-south markets contribute the remaining 25 per cent. The revenue from the non-south markets has grown from Rs. 73 crore to about Rs. 350 crore in the last three years.

The inverter category, which had negligible revenue in 2010, has grown to more than Rs. 150 crore in three years. Mature categories like stabilizers have grown at a compounded annual growth rate (CAGR) of above 20 per cent, while wires which is another large category has grown at above 45 per cent CAGR.

“Today, we have about 15 sales offices and warehouses and all necessary infrastructure to grow the non-south markets,” states Chittilappilly. He adds, “These achievements are the result of our continuous investment in technology, research and development and brand building.” The company has launched new variants of its existing products that are suited to the requirements of the non-south market.

While the growth in the stabilizer, wires and water-heater categories are due to the company’s expansion in to the non-south markets, growth in the pumps category is due to the lack of rain which has fuelled demand for replacement pumps. “Inverters being a new product category are on a smaller base which grows faster and has been helped by power cuts across India,” says Chittilappilly.

The turnover for induction cooktops was Rs.11.35 crore and domestic switchgears was Rs.7.28 crore for the first nine months of FY 12-13. “This is very encouraging considering the fact that we are selling these products in only two to three states in the south,” states Chittilappilly.

The success has come with its set of challenges. The fluctuation in the prices of the commodities, slowing demand in India, high interest rates and the persistent inflation rates are some major issues that it is facing. “Throughout FY 12-13 the input costs have gone up although the last quarter has seen some raw material softening,” says Chittilappilly.

Operational benefits

V-Guard has been outsourcing 60 per cent of its production since 1987 while the rest is manufactured in–house at its facilities in Coimbatore (Tamil Nadu), Perundurai (Tamil Nadu), Kala Amb (Himachal Pradesh) and Kashipur (Uttarakhand). “Here, my father is often referred to as the pioneer of outsourcing within India. Hence, it is very much a part of our company culture to work with vendors and outsource production while making sure quality specifications are strictly monitored by our quality assurance engineers posted at vendor units,” shares Chittilappilly. This helps the company de-risk production and also ensures lower capital investment in terms of plants and other assets.

As far its product basket goes, it forayed into products across the board like pumps, motors, water heaters, solar water heaters, cables. The company operates in two broad channel segments – white goods and durable retail channel and hardware and the electrical retail channel. Apart from solar water heaters, most products are sold by either of these channels.

“Our strategy is to leverage on the strength of our existing network in electrical products and consumer durable retail. We choose to foray into products which belong to either of these channels,” says Chittilappilly. The company currently has a 150-member research and development engineering team, which works on products across electronics (stabilizers, inverters and UPS systems), electrical (water heating systems) and electro-mechanical segments (pumps, motors, fans and yet to be launched mixer-grinder segments). Apart from this, it has a designated team working on solar water heating solutions.

Currently, the wires category (launched in 1999) is the single largest contributor to the company’s revenue contributing 28 percent of overall revenue. “We have negligible project sales. The retail channel contributes to the majority of sale in this category which ensures us a better margin with no risk of bad debts,” confirms Chittilappilly.

Growth strategies

Going by its long-standing operations in the South, V-Guard is among the top players in the market enjoying significant brand and product recall amidst the well-established players. In the recent past, the company’s strategy has been to focus on improving the share of relatively newly launched products like inverters, fans and solar water heaters. “Our go-to-market strategy has been well thought out and simple. We take our products to the market in ways that best suit the needs and usage patterns,” says Chittilappilly. Expanding its reach across the states requires the company to get into the depth of the regions. It currently has a rural market awareness campaign that is travelling from state to state, reaching towns and regions where it sees market potential. Some of the markets that the company has covered include Karnataka, Andhra Pradesh and Rajasthan. The company currently has a network of 28 branches, over 250 distributors, 2,500 channel partners and 13,000 retailers across the country. It has more than 1,850 employees and over 5,500 indirect employees through its SHG initiatives.

Continuous innovation in products is the company’s core mantra. It advertises in many publications and is looking at an aggressive marketing strategy to penetrate new markets. The company spends around 3.5 per cent to 4 per cent of its revenue on advertisements and expects to maintain the advertising spend going forward. It is currently advertising during the IPL as well as on Hindi general entertainment channels.

Going forward

In this financial year, V-Guard is planning to launch its mixer-grinder segment. “At present, we are looking at importing these products from China. We will set up an assembling facility at Himachal Pradesh in a year or two,” says Chittilappilly. The company has mapped out its capacity expansion. It is expanding the production of its wires at the Kashipur plant in Uttarkhand from 2.75 lakh to 5.5 lakh coils per month at an estimated cost of Rs. 18 crore.

In addition, it has also started the solar water heater production unit in Perindurai in Tamil Nadu, which has the capacity to produce 1,00,000 water heaters per annum at an approximate cost of Rs. 10 crore. The company is aiming to grow at a CAGR of 20 per cent to 25 per cent in the next five years. “If we achieve this goal, it will make us the second or third largest player in most of categories we operate in,” concludes Chittilappilly.

SNAPSHOT

V-Guard Industries

Founder: Kochouseph Chittilapilly

Year: 1977

City: Kochi

Turnover: Rs. 1,370 crore for FY13

WHAT NEXT?

Launch mixer-grinders

Set up an assembling facility at Himachal Pradesh in a year or two

Expand the production of its wires at the Kashipur plant in Uttarkhand from 2.75 lakh to 5.5 lakh coils per month