With its two-pronged approach of agri-warehouse management and credit to farmers, Sohan Lal Commodity Management aims to double the number of warehouses in a year and reach a turnover of more than Rs. 2,600 crore in FY15-16.

India has always been an agrarian economy but as things stand, there is certainly room for improvement in the way the industry functions. The wave of innovation has not yet hit home like it has in other sectors and a few companies such Sohal Lal Commodity Management (SLCM) are looking to bring things up to speed. New-Delhi based SLCM, which started as a pulse processing business in Punjab in the pre-partition era, aims to address the problem of storage through its patented Agri Reach technology, a warehouse management solution that is location and infrastructure agnostic.

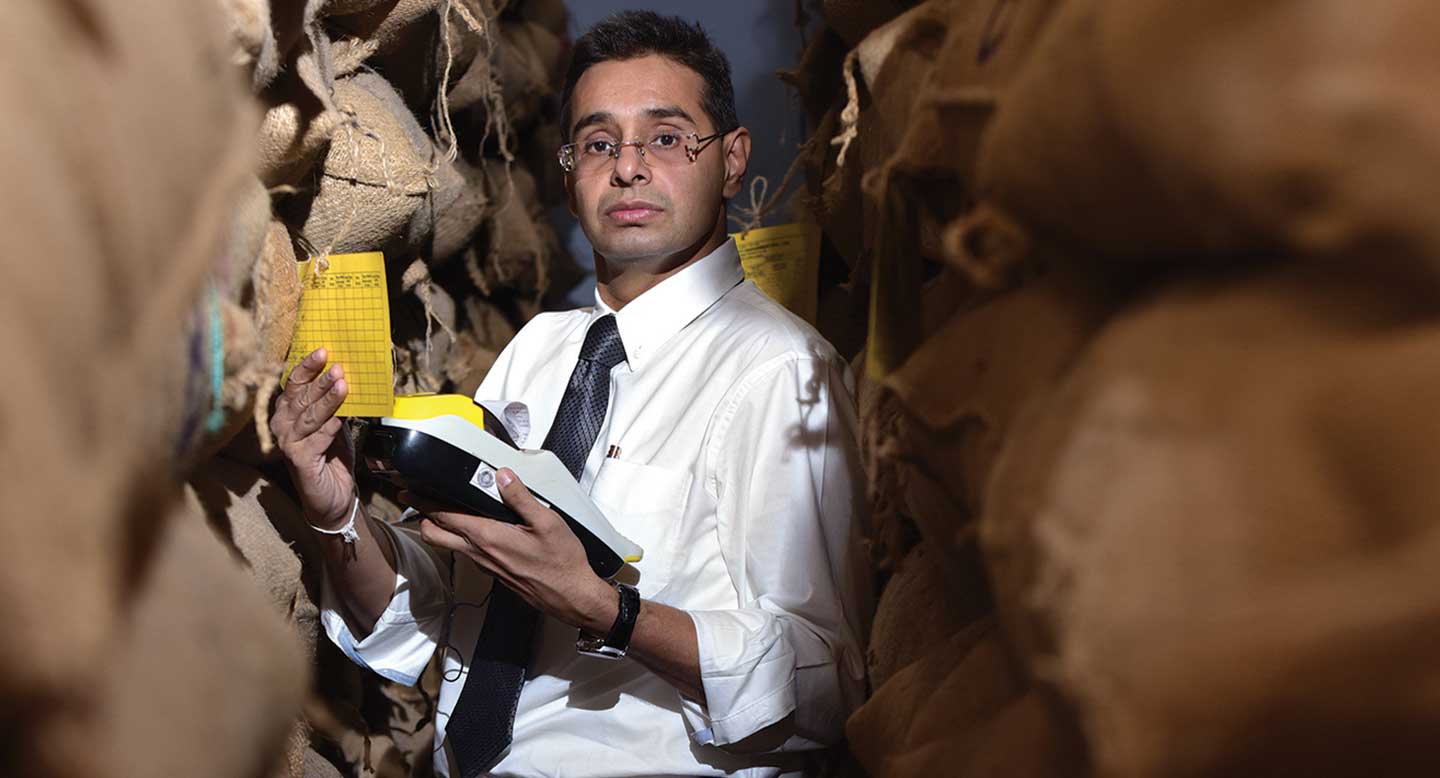

Sandeep Sabharwal, promoter and group-CEO, explains briefly his move to join the family business, “After partition, my grandfather started the mill in New Delhi. My father, who was a gold medalist in engineering, joined reluctantly after working in that line for 28 years. I joined because there was no one else to take over.”

Sabharwal realised that there were certain issues farmers faced which were not being addressed at all, for instance, they needed someone to manage their crops when in storage. In India, post-harvest losses are pegged at 10 per cent. In 2009, soon after he joined, the company started crop management as a side business at one location. Within one-and-a-half years, the response was tremendous because there was a need and no one else was addressing it.

Disrupting commodity distribution

Agri Reach is a standard operating procedure (SOP) which amalgamates technology with agriculture domain expertise and allows SLCM to operate any warehouse agnostic of infrastructure, location and weather pattern across any kind of agricultural crop. The solution protects product quality till it reaches the retailers and has cut post-harvest losses to 0.5 per cent. “We have created a disruptive solution for commodity distribution based on scientific principles,” says Sabharwal. It predicts the behavior of the produce from tell-tale signs and provides solutions to correct it and 44 such audits are conducted and mapped every 30 days in real time.

As a result, from one warehouse and three employees, SLCM now operates 760 warehouses and 17 cold storages across 17 states with a total capacity of over 1.77 metric million tonnes (MMT) spread over 9.66 million sq. ft. area and a throughput of more than 240 MMT. The company handles 157 varieties of agricultural products and some of SLCM’s clients include Ruchi Group, MPWLC, Glencore and Sharp.

As it can be used in any sort of warehouse, at any location, SLCM has already started SLCM Myanmar. “We will be going to countries with agrarian economies, but map it to India – that is, those who export to India as India is at our core,” says Sabharwal.

Attracting PE attention

The good work done by SLCM in 2009 caught the attention of private equity investors. Despite having a management degree, Sabharwal candidly admits that he was not aware of what it would mean for the business to bring in PE. “One, I was in the agriculture business. Two, back then, PE was not as well known as it is today,” he says with a laugh. He thought they wanted to give him a loan and would refuse to entertain phone calls until a representative from ICICI persuaded him to let him explain how it worked. “Even then, I thought there was a catch but decided to go ahead,” he adds.

Bengaluru-based Nexus Venture Partners was the first PE firm to invest in the company. Since then, SLCM has received four rounds of FDI, with Nexus Venture Partners, Mumbai-based Mayfield Fund, Mumbai-based Everstone Capital, New Delhi-based Emerging India Fund by ICICI and Creation Investments Capital Management. Together, they have invested nearly Rs 126.15 crore of capital in SLCM. “The validation of our work is the fact that most have them have participated in at least two rounds and none has left us yet,” points out Sabharwal.

Financing the farmers

SLCM is not a company that rests on its laurels, instead, it looks to dig deep into issues that plague the agriculture industry and help set things right. One of its areas of concern is the increase in suicide rates amongst farmers. “Today, credit is abundantly available but the terms do not take the agricultural business into consideration. Farmers do not have a balance sheet but they have crop,” says Sabharwal. Therefore, SLCM started a wholly owned NBFC called Kissandhan. It provides farmers with finance across diversified agri-products whilst being agnostic to balance sheet of the borrower yet complying with the prudential norms of RBI. “In a short tenure of a year, Kissandhan has already financed more than Rs. 250 plus crore for multiple commodities pan India,” he says while adding that an internal analysis shows that the company has impacted 30,000 farmers across the country.

Reaping the benefits

SLCM’s success has not come easy but it has been satisfying to the founding family. “We had to first break the perception that agri-warehousing can be independent of location, weather conditions and infrastructure. It is a turnaround in attitude,” says Sabharwal. Secondly, this is not a glamorous business and yields low RoI while needing employees to work in rural areas. Still, the company’s 500 direct employees come with rich experience and commitment and a focus on risk management.

The company has created a plug and play process such that any new warehouse can become commercially viable within 48 hours.

The Group expects a multi-fold growth in turnover and profits and it aims to reach a turnover of more than Rs. 2,600 crore in FY15-16 from the current Rs. 1,923 crore in FY14-15. The company has been reporting a CAGR of 71 per cent in revenues in the last three years starting FY12-13. For the current fiscal FY15-16, SLCM has targeted an EBITDA of around Rs. 70 crore, a CAGR growth of 98 per cent since FY12-13.

SLCM plans to double the number of warehouses in a year and expects 300 per cent growth for Kissandhan, taking loan disbursal to Rs. 750 crore. It also plans to step up its international expansion and apart from Cambodia and Laos, is looking at African countries with good law and order to take Agri Reach.

“I am serving a need. When you make a product that matches a need instead of force-fitting a need to a product, you are bound to succeed,” says a contented Sabharwal.

Snapshot :SohanLal Commodity Management

Year: 2009

Founders: Sandeep Sabharwal

Industry: Agri warehouse management, credit to farmers

Investors: Nexus Venture Partner, Mayfield Fund, Everstone Capital, Emerging India Fund by ICICI & Creation Investments Capital Management