City Union Bank (CUB) is India’s oldest listed private sector bank. Team Smart CEO caught up with Dr. N. Kamakodi, CUB’s MD & CEO to talk about his top few priorities today, key decisions made over the years and the role of CUB in the overall banking landscape in India.

Key Highlights from the article

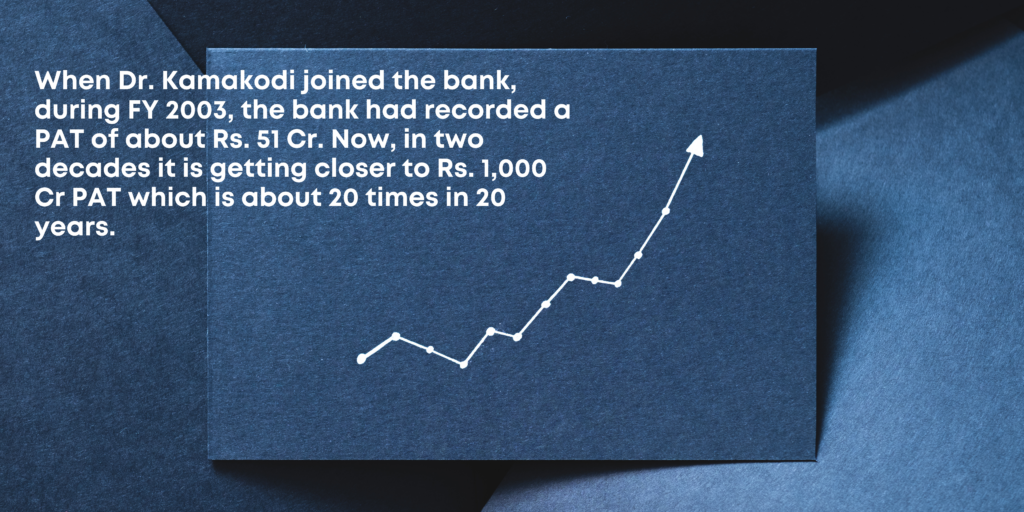

- When Dr. Kamakodi joined the bank, during FY 2003, the bank had recorded a PAT of about Rs. 51 Cr and now in two decades it is getting closer to Rs. 1,000 Cr PAT which is about 20 times in 20 years.

- CUB has had an unmatched legacy of 120 years of continuous profitability and dividend declarations, an achievement that has been possible thanks to continuous transformation to keep pace with sectoral changes

- The bank is now gearing up for the next phase of transformation with people and technology as key areas of focus

Please take us through the key highlights of your journey at CUB since the time you joined the bank.

CUB is the oldest listed private bank in the country. It is entering its 120th year of service to the nation. My entry into CUB coincided with the ‘Centenary Year’ of the bank. I joined the bank in the year 2003 as Deputy General Manager in charge of Planning, Business Development and Human Resources departments. Being a third generation CUBian helped me in understanding the ‘Culture’ of the bank and helped me to properly align the ‘Strategies’ with that of the ‘100-year legacy’ we had.

Later I was given the responsibility of the ‘Advances’ department of the bank before being made the Executive Director/Executive President of the bank. Before becoming MD&CEO in 2011, I had the opportunity to gain hands-on experience in almost all the departments.

In these two decades, the equity investments by organizations like LIC and Foreign Institutional Investors through preferential allotment proved to be an important moment in the history of the bank – which pushed CUB in to the next orbit of growth.

The branch expansion and technological upgradation that happened in these two decades laid the foundation for the next phase of growth.

CUB is one of the pioneers in making every employee a shareholder through an ESOP scheme which made every employee to feel the ownership in the bank irrespective of cadre.

When I joined the bank, during FY 2003, the bank had recorded a PAT of about Rs. 51 Cr and now in two decades it is getting closer to Rs. 1,000 Cr PAT which is about 20 times in 20 years.

God had been kind enough to make me to be part of this journey.

What are your Top 3 Priorities at CUB in the next few years?

Banking sector always goes through transformations and ‘organizational transformation’ is a continuous process to make any institution stay relevant in the market. CUB is not an exception to this rule.

Keeping the next ten years in mind, CUB has to re-orient its people, processes and technology. The changes in technology are opening new opportunities in banking, which were not available earlier. For example, digital technology is making the banks to work without constraints and next three years is going to be crucial for all banks including CUB to adapt to those changes.

Along with technology, re-orientation of Human Resources of the bank to adapt to those changes will be among my top priorities.

What are some of the biggest decisions you have made as MD of CUB that have impacted the bank positively?

While our bank has not believed in ‘big bang’ decisions, it has always believed in small incremental changes resulting in continuous transformations. This strategy has helped the bank to be among very few banks across the world that can claim to have 120 years of continuous profitability and dividend declarations.

The digital transformation of the bank and HR transformation that happened in the bank in the last two decades had been extremely satisfying. I am glad I have been a part of the journey when bank grew from 128 branches to over 750 now.

We are noticing that CUB is planning a few new product launches. Can you take through some of the major strategic initiatives being planned?

CASA plays a big role in determining the net interest margin and cost of funds of the bank. If you look 6 or 7 years back, our CASA percentage was hovering below 20% to total deposits. Because of the coordinated efforts we took in the last decade, CASA had slowly and steadily grown and now stands at 30%. We wish to strengthen our CASA position and hence we have launched the salary account product. We are implementing digital lending process in order to have a quick turnaround time on credit decisions with the help of API/account aggregators.

We are also making tie-ups with Fintech companies as part of the digital lending process. This will help us to venture into new verticals like housing and vehicle finance as well as co-lending models. We had issued the CUB-Dhi credit card which had received good response from our customers. Our lending is mostly secured with a focus towards MSMEs, Traders and Agriculture/related sectors. Our new strategies will not change anything major in terms of our credit mix but will definitely enhance our growth.

Where would you position CUB in the overall landscape of Indian Banks and Financial Services companies?

CUB’s purpose defined by the founding fathers was to support local commerce, industry and agriculture. Over a period of a century, the bank has grown from a bank with deep roots in Cauvery Delta region to not just a Tamil Nadu based bank, but a South India-based bank growing to be a PAN-India bank in the future.

Though we are one of the oldest banks in the country, we are not one of the biggest banks but one of the most efficient and profitable banks.

CUB will strive to be an efficient bank adding value to all stakeholders – customers, employees and shareholders.

According to you, what is the USP/Brand positioning of CUB?

You will see a tag line “Trust and Excellence since 1904” in our logo. This summarizes everything.

For any financial institution ‘Trust’ is the most important requirement to stay in business. As a financial institution with 120 years of track record, ‘Trust’ is what CUB has earned through its ‘Excellence’ in everything it does including ‘Customer Service’.

During the first 100 years, it was “CUBians” who stood for the ‘Trust’ and now ‘Technology’ is supporting CUBians to live up to ‘Trust and Excellence’. The line we use in our marketing campaigns (in Tamil) “Easyana Bank -Rasiyana Bank” can be loosely translated to “Lucky Bank-Techie Bank”.

Please share a little bit about your PAN India presence and your plans to scale this up?

We operate in 16 States and 3 union territories. We have opened branches in Tier-1 cities or district headquarters in the western and northern parts of our country. We wish to open more branches in non-southern states in the future and non-southern states are going to get more share of future branches in the coming years.

In the next five years’ time, CUB will have equal number of branches in and outside Tamilnadu.

CUB is known for its long-standing, focused customer base and quality of customer services. What is the secret behind this?

As explained earlier, during the first 100 years, generations of CUBians made ‘Customer Service’ as the DNA of the bank. The ‘Trust’ was built through excellence in customer service. It was passed on from one generation of CUBians to the next generation. The arrival of technology is supporting the bank to graduate into next higher level.

What are some people-related Learning and Development initiatives you are planning over the next few years?

We have a dedicated Staff Training College that provides hands-on training to newly recruited employees, in addition to imparting Continuous Professional Development (CPD) for Middle and Senior Management. We have started digitalization of our learning platform and have launched a cloud-based learning platform wherein the tutorials, video lectures and to-do-tasks are mapped to each employee. Learning and performance appraisal processes will become completely digital over the years.

As the banking sector is becoming more and more knowledge based, CUB is working with many institutions like IIM Ahmedabad, Indian Institute of Banking and Finance to impart continuous training to our people.

Please share your daily professional routine at office. How do you manage time and schedule your week?

We have our Computer Systems Department and Treasury at Chennai while all other functions operate out of our Kumbakonam Headquarters. So, I have to divide my days between Kumbakonam and Chennai.

I ensure to meet all batches of CUBians who come to attend training at our Staff Training College both at Chennai and Kumbakonam.

Having a trusted team of executives and leaders helps me to have flexibility with time.

Entrepreneurship City Union Bank