In an interview with Smart CEO, Bala Parthasarathy, serial entrepreneur and investor, takes us through the various stages of his professional life, the lessons he has learnt and unlearnt along the way and his plans for MoneyTap, a consumer credit, fintech startup

“Yes, I like that adrenalin rush. I’m a risk taker and I like the feeling of not knowing what’s going to come next,” admits Bala Parthasarathy. Hailing from Chennai, Parthsarathy has over 16 years of experience in the entrepreneurship space and he has donned many hats from being serial entrepreneur (founding Digital Link, Wyatt River Software and iSelect) to being a venture capitalist. His adventurous streak is hardly surprising. He has climbed the Kilimanjaro, trekked the Andes, Alps and the Himalayas, motor-biked across the African continent, up the highest motorable road in the world at Leh in the quest for experiencing those indescribable moments which have made him what he is.

The IIT Madras graduate started his career as one of the early engineers to build Digital Link, which went public in 1993. Subsequently, he and his friends founded Wyatt River Software which was acquired by SafeNet in 1997.He later started iSelect, a venture which he admits was a failure. The more successful one was Snapfish, which he started in 1999 along with his Harvard Business School classmate and close friend, Shripati. “We raised money in the dotcom boom and then the burst happened. Luckily for us, it happened before we could spend it all, so we had money in the bank,” he recalls. That being said, Snapfish was compelled to make amends to operate in the tight environment. “That’s when Digital Photos took off and we moved from film to digital,” he adds. Snapfish was later sold (in 2005) to Hewlett Packard and Parthasarathy became the Managing Director of HP Digital Photos worldwide. He helped start Snapfish in 20 countries in Europe and Asia Pacific serving more than 100 million users.

He shifted base to India in 2007 while he was still in HP. In late 2009, when he was considering a change, he met Nandan Nilekani (Chairman, UIDAI) for advice and found himself volunteering for the Aadhaar project. He played a key role in defining the application strategy and developer ecosystem for Aadhaar. In 2011, after a year and half of working on the Aadhaar project, Parthasarathy started Prime Ventures, a seed-stage fund.

In 2015, he felt the need to do become an entrepreneur again and saw an opportunity in consumer lending. He started MoneyTap along with two co-founders, Kunal Verma, and Anuj Kacker, with the goal of providing consumer credit products to lower & middle income consumers.

In this free flowing conversation, he takes us through the various stages of his life and the lessons he has learnt and had to unlearn during the course of his entrepreneurial journey and his plans for MoneyTap in the coming years.

Your profile in each of the roles you have had in the last 16 years is similar, yet different. Can you talk about how you transitioned from one role to another?

It’s like letting go of a branch and jumping to another branch hoping that the other branch will bear your weight! There is always this momentary feeling that you might be hitting the ground very hard. I have done that several times in life. Once, I went on a Sahara trip with a group of people I’d met on the Internet. At one point during the trip, I wanted to do West Africa solo. So, I walked away thinking I’m going down this path now and I was alone for the next two to three months. Everytime there is a transition, I feel like that. There is a safe path and I am leaving it to do something different.

Do share with us some lessons that you have learnt in your professional journey so far?

One, iSelect failed because of short-term thinking by a few co-founders. The team also didn’t fully gel. We knew each other and it was not the right team to solve the problem. We just wanted to start a company and we looked at many ideas and picked one.

Two, I learnt the nuances of working with friends and maintaining boundaries. It is possible to make it work. It takes a lot of maturity and understanding. One needs to disagree and not to get emotional about it or take it personally.

Three, luck has a huge role to play in one’s journey. In Snapfish, digital cameras took off and we raised funds at the right time and didn’t spend all the money.

Four, being an entrepreneur keeps you grounded. No matter what your past, you are now climbing a new mountain from the bottom.

Five, it’s important to have a long term vision. If you are obsessed about the exit, you are likely to make wrong decisions and may not be happy.

Six, your goal should be to make the pie bigger and not to take away a piece from the pie. MoneyTap is in a market where 98 per cent of the people do not have credit. So, let’s make that 96 per cent and double the market.

As an investor:

What according to you is the right amount of capital to raise?

You need to raise capital at some point of time. Otherwise, you tend to make short term decisions. So it’s good to raise enough money so that you have two to three years of spending covered for. If you raise more than that, you are over-funded and the fabric of the company breaks down.

Fast Forward to MoneyTap:

Talk to us about MoneyTap and your vision for the organisation?

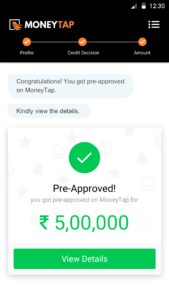

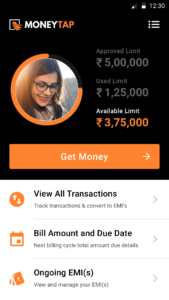

MoneyTap is India’s first app-based credit-line for consumers, offered in partnership with leading banks and NBFCs. Given India’s low credit card penetration & fast-growing smartphone population, the presence of IndiaStack (UPI, Aadhaar) and other changes in the landscape, our goal is to reinvent qualification and disbursement of consumer credit using technology & smartphones. It’s a joint offering with financial institutions where we bring in digital customers through the app, qualify them, share risk (partially), help underwrite them cost-effectively and disburse the money in the form of a credit-line, all on the app, which is backed by cloud-based credit and transaction servers. Since the launch in September 2016, we have attracted over one million users and launched the app in Kannada, Hindi and Tamil in Bangalore, Delhi and Chennai respectively.

We are increasing our employee count and plan to add 50 new team members in the next 6 months. We also plan to solidify the leadership position by improving credit accessibility for other segments of customers, partnering with six other Banks and NBFCs and expanding to 50 cities in India by next year.

How has the company grown and what kind of challenges have you faced in the last one year?

The Indian consumer comes in various hues and shades. With regards to evaluating their creditworthiness, it becomes very difficult if we broad brush all the consumers. Hence, we are constantly working towards uncovering those who are credit worthy and weeding out those who aren’t. It is getting easier to do this by using the digital footprint of these consumers and advanced machine learning and data analytic techniques. But there is still some work to be done. The other challenge is to maintain a sustainable partnership with banks and NBFCs. While we can’t take their capital and blow it up in experimentation, we also need to push the boundaries and keep growing our business. This balance needs commitment and constant work from both parties.

In the last one year, we moved from five cities to about 20 now. We started with giving credit to customers with only salary above Rs. 25,000 and using advanced data analytics we were able to identify good customers (that can be lent to) earning below Rs. 25,000 per month. We are transforming by using Big Data in almost every aspect of our business – that will also help us make better credit decisions going forward. We now have most banks/NBFCs working with us, and this has come by getting quality customers with NPAs under control.

How would you react if your competitor raised big money?

A competitor backed by big money means we’re likely on to something. It’s a sign that our sector has been validated by the investors and it becomes much easier for everybody else afterwards. And one of the best things about a competitor getting funding is that they will use the money to educate the market, which obviously also helps us.

But yes, it also means that there is more noise in the market and things will become expensive for us. However, a competitor raising money will not get a knee-jerk reaction from us. We are well funded and have a great product. We’ll continue doing what we do the best.

What is the secret to establishing a product-market fit and please share some strategies on this aspect from MoneyTap?

The story behind MoneyTap is rooted in how an average Indian leads his/her life. Growing up in India, especially in middle-income group families, we all face a shortage of additional funds at some point. For us, the idea was essentially a combination of personal experiences and general observations. We realized that most Indians (especially salaried class) faced several challenges when it came to getting credit, more so for smaller amounts.

Our data-backed research reflected that people are not comfortable going to banks for loans for minimal amounts – this could range anywhere from Rs. 3,000 to Rs. 50,000 to Rs. 2 lakh. Thus, for even the simplest of credit needs such as medical, birth or death, school fees and deposit to take a house on rent, people are put under high scrutiny. This is where we thought that an innovative, people-friendly credit product like MoneyTap would be a friend they could reach out to in times of need and get immediate help.

Where do you see your organisation three years from now and how do you plan to reach there?

We will expand our focus to 100 tier-2 and tier-3 cities and lower income segments. We need to innovate in order to penetrate these segments. The needs are acute for them but the challenges of serving them are daunting. But with rapid smart-phone penetration and cheap data plans, the winds are blowing in the right direction for us. We need to come up with products that go way beyond what is in the market today to be able to cost-effectively address them.

In the early 90s, Hindustan Lever changed shampoo consumption in the mass-market with the introduction of sachets. We need to adopt a similar strategy in credit and financial services.