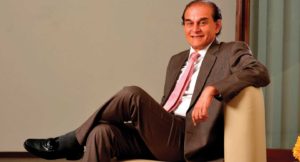

Narayanan Vaghul, former chairman, ICICI Bank, draws ideas from American Generals during World War II, the life of Mahatma Gandhi and even Sachin Tendulkar’s cricketing career to explain, in simple terms, the finer nuances of becoming a successful business leader

Note: While this interview was done a few years back, the lessons from this article are timeless.

Several iconic business leaders including Anand Mahindra, Lakshmi Mittal and Azim Premji have Narayanan Vaghul’s phone number on speed dial. They turn to the renowned banker to gather his opinion and advice on various strategic and financial decisions they make in their complex organisations. Vaghul, today, is a member of the board of directors of Mahindra & Mahindra, ArcelorMittal and Wipro Limited, in addition to advising several entrepreneurs and growth companies.

Vaghul, of course, is known for his achievements at ICICI Bank and for his role in creating several institutions under the ICICI umbrella. He started India’s first ever venture capital company (ICICI venture) in 1987, pioneered the concept of credit rating in India by establishing CRISIL (also in 1987) and laid the foundation for a universal banking model, a model which caters to the banking needs of various customer segments. In 2009, he received the Padma Bhushan from the President of India for his contribution to Indian trade and industry.

We caught up with Vaghul to gather leadership lessons that he has learnt from over 50 years in business.

The best lesson I learnt

The one that readily comes to my mind is from one of the earlier institutions I started. I knew that the key to the success of the company depended on the person I would hire to lead the venture – the CEO. I was clear that my role was to provide the macro vision, but it would be the CEO who would get the job done. (At this point, I do not want to mention the name of the company or the CEO, but it is the lesson learnt that is important).

It was a startup company with plans of implementing a novel idea. I spent a lot of time in recruiting the right leader. Then, I identified a person who, I thought, was extremely competent and had great credentials. I also made a few enquiries and the references were all positive. I decided to hire him. The person had to let go of his government position, leaving a fairly secure job, but he was ready to take up the challenge.

However, within two months, I realised the partnership was not working out. His priorities were different and somewhat mixed up, and his ideas did not match the vision I had for the company.

One option I had was to carry him along, reconcile to the fact that I had a made a mistake and make the best out of the situation without firing him. I am talking about the 1980s, a time when firing people did not come naturally to a person.

I shared the whole story with Azim Premji (of Wipro), an iconic figure today and asked for his advice. Premji suggested that I cut my losses and take the tough decision of going in for a separation (firing the person). The cost of separation, financially, was quite high and on top of it, there was an element of guilt. I had hired him from the government, which was fairly secure. But I bit the bullet. The business was far more important to me. A separation happened and I brought in another person.

The lesson I learnt here – a very valuable one at that – is that the success of the business lies in the choice of people, even if it means making some very tough decisions. Later in my career, I took several such tough decisions. For example, even in my own succession, when I brought in K.V. Kamath, I am sure I would have hurt some people. But the success of the business and the choice of the right person are important.

“In several cases, failures of businesses are attributed to the inability to make decisions, especially tough ones, at the right time.”

Managing people

Managing people really means staying close to them. So, how do you stay close to them? Not through socialising or by throwing parties or by playing golf with them. We need to understand that gimmickries do not work and develop genuine concern for people.

When I joined ICICI, we had about 800 people in Mumbai. In a short span, I got to know each and everyone by name. I used to leave my door open between 8 a.m. and 9 a.m. every day and anyone from the office could walk in and talk to me about anything. It could be about the bank or it could be about their personal lives; I never said, what you are saying here is irrelevant. It showed me an aspect of his or her personality. One thing we need to remember is not to be artificial. Never shut your ears to any kind of feedback you are getting.

The second important aspect is managing people by example. People keep looking at you – how you behave, how you smile and how you conduct yourself. Keep looking at yourself and make an attempt to elevate yourself. We need to motivate people by example and by who we really are. You cannot tell a person, do not be corrupt, when you are corrupt yourself. None of these things can be hidden. Your faults will show up at some point of time.

“Leadership is by example and that is what motivates people. You need to develop genuine closeness with your people in your organisation.”

The early phase of launching a new company

CRISIL was a classic example of introducing a new company when the country was not ready for it. In the mid 80s, when I wanted to launch a credit rating company in India, the methodology we had for interest rates was contrary to what would work normally. The sicker a company, the lower its interest rates would be. The companies that were performing better had to pay a higher interest rate. So, at a time like that, how does one launch a credit rating company?

We did not know the rules of the game, then. The thinking was in order to add credibility and bring in the knowhow: we must rope in an international partner. I pitched to a few international companies – Moody’s, Standard & Poor’s and Fitch, the then leading credit rating companies globally. Moody’s was the only one who responded. They sent a two-member team to India to study the environment. At the end of their two-month visit, the team from Moody’s visited my office and told me that the country was not ready for it and Moody’s was not in a position to partner on this one. I responded saying, “Irrespective of your decision, I have decided to go ahead with my idea. While credit ratings might not be relevant today, five years from today, the country is going to transform (this was in the mid-80s). It is going to take a while to get my organisation ready, so I am going to start today.” IFC (International Finance Corporation), Washington, said they were willing to join hands, but only if I managed to get an international partner. I repeated my reason for starting off immediately even without an international partner.

CRISIL was born and I lured Pradeep Shah from HDFC to become the managing director. He was entrusted with building the organisation from scratch. A couple of years later, Pradeep came to me and said, “We have hired these 40 people, all with great credentials and experience. But they are all a little disillusioned. There is not much work to do, we are building all these systems but there is not enough business. The employees are concerned if this is really going to work.” He then added, “I request your help. I need you to come and address the 40 employees of CRISIL.”

“When you introduce a new product or service, you should always have an anchor. CRISIL succeeded because it had ICICI as an anchor. Most businesses have a long incubation period – say, two or three years.”

![]()

I addressed them: “Regardless of what happens in this business, your future is safe. Each and every one of you will be taken into ICICI, a company with deep pockets. You do not need to worry about your future, just concentrate on the business.”

I did not realise the impact then, but Pradeep told me that this talk had a very positive impact. Of course, as we all know, two years later, things started to look up. The economic reforms happened, business boomed and Standard & Poor’s showed interest to pick up a minority stake (today, CRISIL is owned by Standard & Poor’s as it gradually acquired the whole company).

So, the lesson is, when you introduce a new product, you should have an anchor. CRISIL succeeded because it had ICICI as an anchor. Most businesses have a long incubation period – say, two or three years. For that time period, you either raise money from venture capital or private equity, or you need to have an anchor client who can give you enough revenue to cover your expenses.

“In the early phase of launching a business, a new product or service, you should always have an anchor.”

Managing financials

It is actually a very simple lesson I would like to suggest here. You do not spend until you earn. It seems to me that several early-stage entrepreneurs are technically very strong, but do not have a good commercial sense. I would even go to the extent of saying that this is true in 70 per cent of the cases. One should never assume that revenue will start flowing a year from now. Conservation of cash is the key to the whole thing.

Let me narrate a story here. A long time ago, I had a visitor in my office. It was the Late Darbari Seth, then the managing director of Tata Chemicals. Apparently, we had met two years earlier (I did not remember the meeting at that time) and I had casually mentioned that liquidity is going to become very tight. So, I had happened to tell him: “Cut down your expenditure, we are in for bad times.” Two years later, he said: “I must tell you how thankful I am. We saved tremendously because of that piece of advice.”

Even in the boards I am associated with, when I look at the financials, I ask, how strong is your liquidity? This is true even in the management of my personal finances. My wealth manager suggested that I move some money from my savings account into an investment opportunity. I disagreed and told him that I need money to pay my advanced income taxes six months from now; I need a level of comfort. Conservation of cash and liquidity is crucial in any scenario.

The second most important aspect is to never get into a debt to the hilt. Kingfisher Airlines is a classic example of that. You cannot expect that things will turn around and so, take on debt. I recently met another entrepreneur who did not have stable revenue streams for three to four years; yet, he had organised debt because he could not raise private equity. I was aghast. I told him, somehow, he needs to find a private equity investor and repay the debt.

This applies to much larger companies as well. Even at companies like ArcelorMittal (Vaghul is the chairman of the audit committee), we constantly evaluate if debt can be serviced by future earnings. As conservative financial management people, entrepreneurs should always ask themselves ‘what if things do not turn out as planned? What if we do not make the EBIDTA (earnings before interest, taxes, depreciation and amortization) we expect to make in the next year?’

Look at what happened in 2008 (the financial meltdown in the U.S.). It is a dynamic environment, so you never know what is in store. Planning for a difficult period is crucial.

“Conserve cash and never take on debt you cannot service. Never spend till you earn!”

![]()

On the approach to growth

I have always believed that a company has to grow gradually. This leap forward frightens me. However, it could be a personal characteristic. When ICICI was a development bank (before the foray into retail banking), we grew by about 20 – 25 per cent, maybe more. Now that I am discussing this 20 years later, I can reflect and say that the penalties we paid for this growth were quite high. In the second phase of ICICI (as a commercial bank), we did grow very fast on the retail front. We decided to be market leaders. In home mortgages, we took on HDFC. We became leaders in automobile and two-wheeler financing, and even credit cards.

I heard this story in the boardroom once. The person who was heading credit cards at ICICI was hired from Citibank. When his turn came to talk, he said, at Citibank, people thought that ICICI was irrelevant in the credit cards space. He wanted to prove a point. At a point in time, the same person came back and said: “Now, we’ve issued more cards than Citibank.” Even in terms of spends on credit cards, ICICI became the market leader.

Overall, we were growing at a furious pace. When Chanda (Kochhar, the current managing director and CEO of ICICI bank) was appointed, we had a clear strategy. We said to ourselves, growth is not all that important – building a strong foundation is crucial. It requires courage for a company that was growing at a furious pace to come down and say, I am going to control growth and the focus would be stabilisation rather than growth. We decided we could correct our cost of funds. This happened in the last of the strategy meetings I presided.

In light of all the experience I’ve had over the years, I would say that growth is not necessarily the main objective always. However, it would be foolhardy not to grow furiously if there is a vacant space and you have the tools handy to deliver in an area. You cannot blame Steve Jobs for selling so many iPads. But very rarely in your time, you get a product that can capture the imagination of people in such a sweeping fashion. For a large percentage of businesses, growth needs to be there, but not furious growth.

I have learned one thing: the moment you set yourself an objective of overtaking a competitor or capturing a particular market share or maintaining a particular growth rate, something gets into your head and your thought process about the business goes haywire.

In the battlefield, there are broadly two theories: the broad thrust strategy, which was supported by General Bradley and President Eisenhower, and the narrow thrust strategy, which was suggested by General Patton and Montgomery. The narrow thrust strategy was to go straight to Berlin and attack Hitler there. The broad thrust strategy meant you move forward on a broad front – you move gradually along the flanks as well. The danger with the narrow thrust strategy is that your flanks are open and your enemy could come in from the flanks and attack you. Instead, if you protect your flanks, move in from the right and the left, you reach your destination a little slower but the risks are lesser. I, for one, prefer the broad thrust strategy. I prefer to create a foundation and then move.

“Sometimes, stabilisation becomes more important than growth. Growth need not necessarily be the primary objective always.”

![]()

Dealing with failure

There is a lot of conventional wisdom on this subject. If a person works towards fulfilling a much broader social cause, in addition to making money in his business, it will certainly help and failure will not affect the person as much. I think it will be useful to have a framework in your mind to tell yourself that you are there for a purpose.

Fortunately, I happened to stumble into an organisation that had the opportunity to help with the economic development and the industrialisation of India. ICICI did make money and profits, but it played a role in the economic development of India. When you set your eyes on a much larger goal, you might stumble and fall, but you can rise again and run towards your destination.

“Of course, businesses are for making money and profits. But setting your eyes, genuinely, on a broader social objective will certainly help you perform better.”

Balancing short-term versus long-term

If you are a startup, stabilisation of the company is the key aspect. You have to be very clear in your mind about what you need to do to stay in business, but at the same time, you must not lose sight of the long-term objective.

Take Sachin Tendulkar’s cricketing journey. I am sure, in his mind, he would have had the objective of a 100 centuries. But on a match day, he’s thinking – I need to play well, I need India to win today.

In our times, we used to joke about the quarter-se-quarter-tak (from one quarter to another) syndrome. We have to be clear; businesses are built over the long-term. Keep the long-term objective in your mind, but on a given day, you still need to make short-term progress without losing sight of the end objective.

“Never lose sight of the long-term, but think about short-term progress day-to-day.”

![]()

How does one build a great company?

One needs a selfless vision and a broader purpose to build a great company. There has to be a passion in that. You do not build a great company for making money.

I remember a quote by Henry Ford: “I am building an automobile company so that every American can own a car.” That was the purpose. There are people like that who started companies with an entirely different objective, not for the purpose of making money.

In my mind, what is so attractive about that is, it says you are selfless in whatever you are doing. That idea catches you, you are passionate about it, you may succeed or you may fail, but you are selfless about it and it has nothing to do with your personal fortunes.

“One needs a selfless vision and broader perspective to build a great company.”

![]()

How can ethical people sometimes become unethical?

Never compromise on ethics. The question of ethical people becoming unethical comes up because of the pain it causes. Some people rationalise it by saying it will cause pain to shareholders, so I do not want to inflict pain to my shareholders. The only way you can stay ethical is by not compromising at all.

When it comes to ethics, I always quote the example from Mahatma Gandhi’s non-cooperation movement. When he started the Satyagraha movement in the early 1920s, the British were completely taken back. Initially, they dealt with it in a very light-hearted way (thinking, what can this man do?), but when the whole country was rising up, the British were shaken up.

Then, an incident like Chauri Chaura (in 1922, a police station was set on fire by an angry mob killing 23 policemen) took place where there was violence. Gandhi said stop it; he was not going to support this. The film (Gandhi) captures it with graphic details – Nehru, Patel and all the Congress leaders pleaded to him saying, they have the British on the run and the Chauri Chaura incident was a minor happening. But Gandhi said, “If independence has to be won because of this (bloodshed), then we do not want independence.” The non-cooperation movement was called off temporarily and only several years later independence was won. That is the way an ethical person will have to think. No compromises, whatever the circumstance, whatever pain it causes.

“When it comes to ethics, never, ever compromise.”

![]()

EXECUTIVE SUMMARY

Several Indian business organisations, startups and large companies alike, are going about building a business in a complex environment. Various factors – internal and external – push business leaders and managers to come up with solutions to business problems on a day-to-day basis. This story focuses on emphasising on the basics of business leadership and why India’s upcoming entrepreneurs should never let go of these basic rules. By no means is the list exhaustive, but it sure does serve as a guideline to managers and entrepreneurs. We turned to Narayanan Vaghul, former chairman, ICICI Bank, to help us come up with this list

In several cases, failures of businesses are attributed to the inability to make decisions, especially tough ones, at the right time.

Leadership is by example and that is what motivates people. You need to develop genuine closeness with your people in your organisation.

In the early phase of launching a business, a new product or service, you should always have an anchor (a client, mentor or investor).

Conserve cash and never take on debt you cannot service. Never spend till you earn.

Sometimes, stabilisation becomes more important than growth. Growth need not necessarily be the primary objective always.

Of course, businesses are for making money and profits. But setting your eyes, genuinely, on a broader social objective will certainly help you perform better.

Never lose sight of the long-term, but think about short-term progress day-to-day.

One needs a selfless vision and broader perspective to build a great company.

When it comes to ethics, never, ever compromise.

NARAYANAN VAGHUL, 75

Key corporate positions held:

Currently member of the board of directors of Mahindra & Mahindra, Arcelor Mittal and Wipro

Former chairman of the board of ICICI Bank and has also served as its CEO for 11 years

Former chairman of Bank of India

Contribution to policy formulation:

Has been chairman and member of various committees created by the Government of India and the Reserve Bank of India

Has worked on various assignments for the World Bank, IFC and Asian Development Bank

Was briefly the chairman of the Government’s Foreign Investment Advisory Board

Social contributions

Governing board of Give India, a donation platform supporting NGOs

Closely involved with Pratham, an NGO focused on education

Accolades:

Credited with setting up India’s first venture capital company, ICICI Venture, in 1987

Pioneered credit rating in India by setting up CRISIL

Setup a commercial bank (under the ICICI umbrella), which merged with ICICI to become the first major universal financial institution catering to various segments of the Indian population

Awards:

Padma Bhushan award from the President of India in 2009

Lifetime achievement award from Ernst & Young in 2009

Lifetime achievement award from Economic Times in 2006

Businessman of the year in 1992 from Business India magazine

*Source: Websites of Mahindra & Mahindra and Give India

Entrepreneurship Leadership Banking