Sundaram Mutual Launches India’s First Services Mutual Fund – Sundaram Services Fund

August 29, 2018, MUMBAI: Sundaram Mutual, one of India’s most respected and leading retail-focused mutual funds ranked amongst top ten in its folio concentration in the mutual fund industry, has launched Sundaram Services Fund, an open-ended equity scheme investing in Indian Services Sector. Sundaram Services Fund, the New Fund Offer (NFO), aims to invest between eighty (80) to one hundred (100) percent in, predominantly equity and equity related instruments of, Services Sector of the Indian economy that essentially comprises fifteen (15) distinct sub-sectors across Transportation and Logistics, Healthcare, Retail, BPM, Media and Entertainment, Hospitality and Tourism, Online and Financial Services, Fitness, Education, Staffing, Wealth Management, Aviation, Architecture, Legal and Design Services. The New Fund Offer opened for the subscription on August 29, 2018 and closes on September 12, 2018. The scheme reopens for ongoing subscription / redemption from September 26th, 2018.

Commenting on the launch of Sundaram Services Fund, Mr. Sunil Subramaniam, Managing Director and CEO, Sundaram Mutual said, “Sundaram Services Fund is an opportunity to invest in a sector representing 54% of the Indian economy that also happens to be among the world’s fastest growing, at 7.6%, in 2018. The gap between Services share of the economy at 54% and of the market capitalisation at only 35% implies huge potential for the future”

The Fund Managers’ strategy will be to invest in a multi-cap portfolio of Aggressive Small caps, Mid caps and Defensive Large caps in existing (listed Universe of 193 stocks identified with Market Cap of 40 Lakh Crore) and Potential New listings in New Age Services. It is important to note that such new age businesses have garnered Private Equity investments in excess of Rs 1.7 Lakh Crores over the last 5 years.

Sundaram Mutual has entrusted the fund management of Sundaram Services Fund to Mr. S. Krishna Kumar, CIO-Equity, as well as equity fund managers, Mr. Rahul Baijal and Rohit Seksaria. The performance of the scheme will be benchmarked against S&P BSE 200.

About Sundaram Asset Management Company:

Sundaram Asset Management Company, a major player in the fund management space with retail focus, has an accomplished and acclaimed track record since it commenced business in 1996 with assets under management of about INR 37,477 crores as on July 31, 2018.

Sundaram Asset Management Company has a bouquet of equity and fixed-income funds catering to diverse investor preferences.

Sundaram Asset Management Company has 93 locations across India covering all leading centers.

For more information on Sundaram Mutual Fund and its products, please visit www.sundarammutual.com

For Media Enquiries:

Harit S. Tank

Tel.Nos.: 022 – 30100215 Mobile: +91 98194 55607.

Email: harittank@sundarammutual.com or harit.smf@gmail.com

Ajit Narasimhan

Tel.Nos.: 044 – 28569900 / Dir.: 044 – 28569805 Mobile: +91 98840 88925.

Email: ajitn@sundarammutual.com

Fund Synopsis:

Scheme Name : Sundaram Services Fund.

Scheme Type : An open ended equity scheme investing in Services Sector.

Investment Objective : To seek capital appreciation by investing in equity / equity related instruments of Companies who drive a majority of their income from business predominantly in the Services sector of the economy. Services sector includes healthcare, fitness, tourism & hospitality, transportation & logistics, education, staffing, wealth management, media, retail, apparels, aviation, legal, architecture, design services etc.

Asset Allocation :

| Type of Instruments | Minimum | Maximum | Risk Profile |

| Equity & Equity related instruments of Services Sector | 80% | 100% | High |

| Fixed Income and Money Market Instruments | 0% | 20% | Low to Medium |

Benchmark : S&P BSE 200

Fund Managers : S Krishnakumar, Rahul Baijal & Rohit Seksaria & Dwijendra Srivastava (Fixed Income).

Minimum Application Amount : For both Regular and Direct Plan: Rs. 5,000/- and multiples of Re. 1/- thereafter per application.

Load Structure

Entry Load : N.A.

Exit Load : For redemption within 12 months from the date of allotment – 1%.

For redemption on or after 12 months from the date of allotment – Nil.

New Fund Offer Period : The Scheme will open for subscription on 29/08/2018 and close on 12/09/2018.

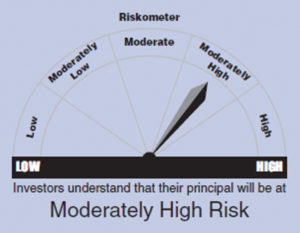

Sundaram Services Fund is suitable for investors who are seeking*

- Long term capital growth,

- Investing in equity / equity related instruments of companies who have business predominantly in the

Services Sector of the economy.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.