MobiKwik, an Indian wallet major with a network of over 2,50,000 direct merchants and 40 million users, is taking strong strides towards realising its vision of digitalising India and head towards a cashless economy.

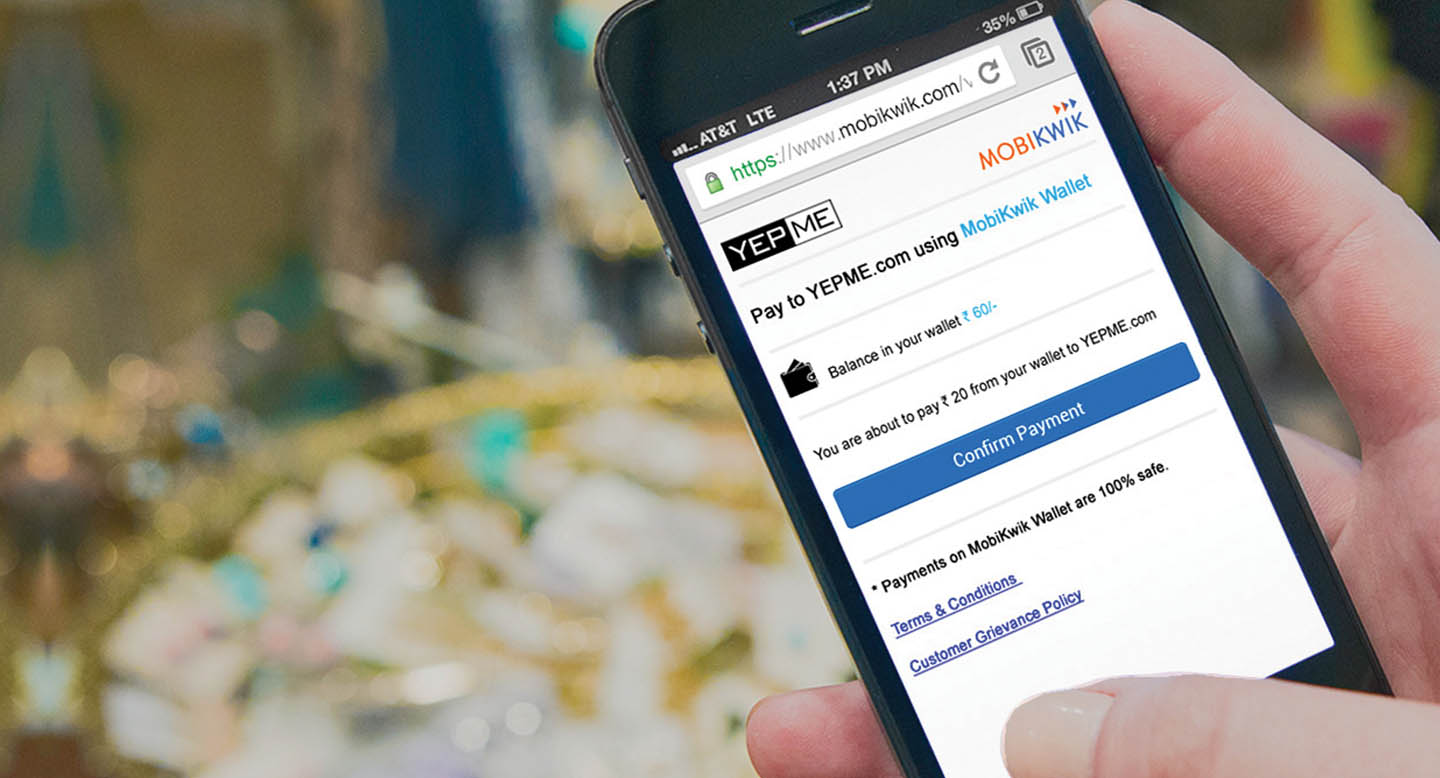

Founded in 2009 by BipinPreet Singh and Upasana Taku with an aim of making mobile payments easier for the average Indian consumer, Mobikwik is an Indian e-wallet company connecting 40 million users with a network of over 250,000 direct merchants. Going forward, the team aims to take the wallet to a billion Indians by driving product innovation and brand marketing.

Our immediate competition is with cash. There is a struggle because there are people who are reluctant to move out from the cash transaction system

Taking fast strides

MobiKwik, an independent mobile payments network, aims to be the largest source of digital transactions in India and is currently powering payments for IRCTC, Uber, Meru Cabs, Big Bazaar, OYO Rooms, Zomato, to name a few. The company raised three rounds of funds (total of US $ 80 million) from Sequoia Capital, American Express, Tree Line Asia, MediaTek, GMO Payment Gateway, Cisco Investments and Net1.

Taking a solid stride towards realising its vision, it recently launched MobiKwik ‘Lite’, India’s lightest mobile wallet that is easy to understand and helps unorganised retailers and shopkeepers across India in receiving payments seamlessly. An app that is less than 1 MB, it works on EDGE connections and will address challenges of slow data connectivity, thus enabling the smartphone users in Indiawho are unable to access digital payments easily. This app will also serve the users from rural India which has the number of regional language users.

The company’s “nearby” feature has helped users identify food and shopping outlets around them that accept MobiKwik payments. Users can also locate cash deposit locations around them with this feature.

Tapping all the channels

The company has launched a Rs. 30 crore campaign across various channels which will continue till January 2017. “This increasein spend is almost four to five times,” admits Singh. But, the company is using vernacular channels of communications, radio ads in small towns to add new users from these untapped areas.

Big opportunities

The company aims to enable every Indian to transact digitally. In fact, it has increased its on ground workforce twelve times and MobiKwik payments will soon be accepted by an additional one million retailers. However, to reach every retailer in this country in the next two months, the company is launching MobiKwik Card in partnership with its investor, Net1. This means that users will be able to use MobiKwik for payments across all online and offline retailers and shops, where credit and debit cards are accepted by January 2017.MobiKwik Card will help users pay through their wallet without having to worry about the merchant’s inclusion in the company’s network.

Apart from this, the demonitisation move by the Prime Minister Narendra Modi to curb black money in India is expected to have positive effect on the company. “Within a 50-day period, a billion Indians will change their payments behaviour – we will move from cash only to a cash-free economy. This will benefit the growth of digital payments and digital banking in India,” says Singh. The company’s user traffic and merchant queries have also gone up by 200 per cent since the announcement of currency notes ban on November 9.

The path ahead

From only supporting bill payments and mobile recharges, MobiKwik now supports user-to-user transfer of funds and has seen a 150 per cent increase in its merchants base since the Government’s announcement of demonetisation. The company has revised its monthly annualised Gross Merchandise Value (GMV) sales target by 10 times to US $10 billion by 2017.

With all these factors favouring the sector, the company is taking strong strides towards realising its vision of digitalising India and serve towards cashless economy.

Snapshot

Founders: BipinPreet Singh and Upasana Taku

Year: 2009

Concept: Mobikwik is an Indian e-wallet company connecting 40 million users with a network of over 250,000 direct merchants.

Investors: Three rounds of funds from Sequoia Capital, American Express, Tree Line Asia, MediaTek, GMO Payment Gateway, Cisco Investments and Net1.