MEMG and CDC funded iGenetic Diagnostics, which uses the molecular technique of next generation sequencing, aims to grow its business through the organic and inorganic route and penetrate deeper into the southern and western markets…

Arunima Patel spent almost a decade in private equity with a strong focus on healthcare delivery. Through this experience, she has met and interacted with the management of the biggest names in the diagnostics industry. This also brought to her notice the various opportunities that existed in this space. “It is a fast growing unorganised market,” she says, while adding that the diagnostics market is almost 90 per cent unorganised. “I knew that there was an opportunity for another big payer to enter ths space. You can create 10 such companies and still not have touched the market scope,” she elaborates. This thought process led to Patel leaving private equity in February 2013 to begin a focused research on diagnostics. Quickly, she understood that her lack of the required technical knowledge was a hindrance and to overcome the same, she met several entrepreneurs and scientists for almost seven months to learn more about the industry. “I wanted to participate in the molecular space as that was fast growing,” recalls Patel. In 2013, when she got her idea, there were hardly any companies in this space. She based her business on the knowledge that there was a shift towards advanced technology in the developed markets that India would likely adopt, sooner or later.

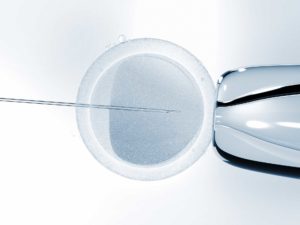

“I met two scientists who had developed some interesting products, especially in the non-invasive space. I partnered with them to start iGenetic Diagnostics (iGenetic),” says Patel. Some of the product designs came from these scientists which iGenetic purchased in return for equity in the company. The company provides a range of tests in the areas of infections, critical care, gynaecology, infertility and cancer diagnostics. It has reduced the detection time for high-end diagnostics like septicemia detection to 24 hours from the norm of three days.

Today, iGenetic operates with an extensive test menu which is its key differentiator in the industry. “We do some unique work. For us it is not just antibiotic resistance by molecular methods, we also do micro biology and give a comprehensive report,” says Patel. This apart, the company boasts of service quality and a strong turnaround time with sophisticated information technology systems.

One stop shop

iGenetic currently offers clinically relevant diagnosis panels in addition to individual laboratory tests. It offers a wide menu of pathology tests ranging from routine biochemistry to advanced molecular pathology. “Our proposition to the patient is that they will get a one stop solution from us. If one is looking at a complex issue like cancer, for instance, one has to look at basic things like pathology work right up to analysis of cancer. We are one place where the patient can get an end-to-end solution,” says she. The company also aims to build its technology in-house and make it more affordable to the Indian market.

The company’s focus will be on the western and southern markets of India and will look at better penetration in these geographies. This is because the technology adoption rate is much higher in these markets.

India’s diagnostics industry is approximately valued at around Rs. 20,000 crore which covers both high-end and routine diagnostics work. Out of this, the high-end diagnostics segment, which includes molecular and genetics diagnosis, is expected to be around 10 per cent of the market and is only expected to grow further. Citing an example, Patel says, “Genomics, a very high-end molecular diagnostic space, is growing at 30 per cent.” Patel and her team are looking at tapping this market as well.

iGenetic has around 400 to 500 customers, including hospitals and chains of clinics, across the Indian market. It has largely been a b2b player with a unique set of tests that require the team to be in constant touch with doctors and specialists. The company also ties up with hospitals for to expand its reach. This apart, other laboratories also send work to the company. For example, many tests that require advanced microbiology get sent to iGenetic. “So far, our consumer acquisition has been largely this way. This is the year post funding when we will start doing consumer marketing in Mumbai,” says Patel.

Funding journey

While in the early days, funds came from friends and family, during the third year of operation, iGenetic had investment from a couple of angels and HNIs. Eventually, it raised around US $20 million from Manipal Education and Medical Group MEMG and UK-based development financial institution CDC Group Plc. These funds will be used to support its organic and inorganic growth plans over the next few years.

The company’s fund raising spanned almost a year-and-a-half which is a long stint especially considering that the founders were from the PE industry and should have been able to do it much easier. “The genomics space is not an easy space to understand,” says Patel. The founders met more than 30 VCs and PE funds and from there, shortlisted the ones that have a healthcare focus. This is the market that a healthcare person has to understand as it requires patient capital. “That was what we found with CDC and MEMG. We also wanted to grow both organically and inorganically and our focus on high-end is what excited them,” says Patel.

Not without challenges

The availability of manpower was one of the biggest challenges that the company faces. Second is the awareness amongst physicians as to what kind of tests are available and what one should look at and deploy advanced methods to solve these complex issues. “We do a lot of doctor meetings on a weekly basis to address this and explain the advancement in technology,” says Patel.

This apart, the space is unregulated, even in the high-end. “Someone who is trying to cut corners can give the same result at half the price and there is no regulation that stops them. There is no benchmark for your lab,” explains Patel.

Up ahead

iGenetic is present in Mumbai, Nagpur, New Delhi and Hyderabad and plans to open in Bengaluru and other metropolitan cities. However, its focus will be on the western and southern markets of India and will look at better penetration in these geographies. “This is because the technology adoption rate is much higher in these markets and this is also why we launched our portfolio in Hyderabad first,” says Patel.

In the last one year, the company has grown well and has almost doubled its revenue and expects to retain this pace of growth during the current fiscal too. “After funding, we are now driving our inorganic growth plan. We are talking to labs with a revenue of upto Rs. 40 crore to Rs. 50 crore for acquisition or partnership, specifically in the western and southern parts of India,” shares Patel. So far, iGenetic has acquired two small labs in Mumbai. These acquisitions help the company increase its distribution network and help in penetrating further into the market.

“We have not done much work in Pune or Kolapur and these are big markets for advanced testing. We may even grow organically there,” says Patel. The company’s strategy to enter a market is to first market its specialised work and eventually try and acquire a routine player there. “High-end work gives us an entry with the doctors and hospitals but the routine gives us volumes and both are important,” says Patel, on a parting note.

Name: iGenetic Diagnostics

Founder: Arunima Patel, Homer Paneri, Siddharth Patodia

Year: 2013

Headquarters: Mumbai

Profile: iGenetic Diagnostics is a diagnostics company which uses molecular techniques next generation sequencing, a high end diagnosis, with a presence in Mumbai, Nagpur, Delhi, Hyderabad and Bengaluru. It aims to focus on the Southern and Western markets and penetrate deeper here through organic and inorganic methods.

Critical success factors:

- Many of start-ups in healthcare genomics space fail because they struggle to raise money. We have crossed that bridge as we found an investor who shares a common vision.

- One needs to have a differentiated offering to get an entry with the doctors.

- Team: Keep them motivated and drive them to learn more and apply that and make sure that they are not away from commercial offerings.