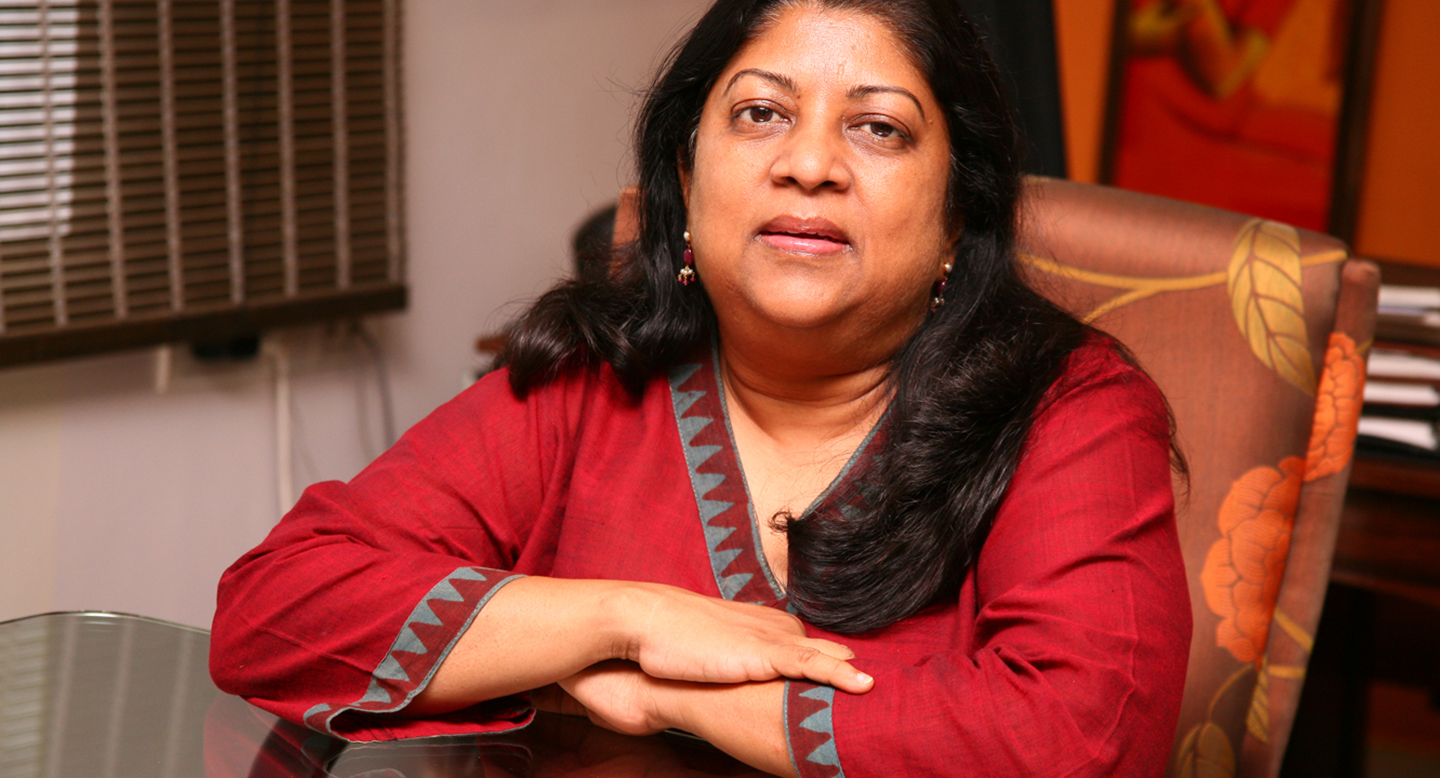

The Startup School debuts with the subject of ‘exits’. While most view an exit as an end, it can often lead to unexpected beginnings or planned deviations. An exit is also a time when an entrepreneur feels most vulnerable, for it means the drawing to a close of one’s dream venture. In her chat with The Smart CEO, Hemu Ramaiah, ex-chief executive officer, Landmark Ltd., touched upon the aspects of her exit from a bookstore chain that was her baby, which grew under her guidance for 20 years.

The Landmark journey

In 1987, Ramaiah set up Landmark in Nungambakkam, Chennai with a modest capital of Rs. 12 lakh. The store, located at the basement of an office building, went on to achieve “cult” status as a reading and browsing destination. Ten years post its establishment; Landmark was instrumental in growing the category of bookstores in south India through its multiple locations across Chennai and Bengaluru. Fast forward to 2005 – Ramaiah and her husband, Jai Subramaniam who served as a director, were faced with the question of expanding operations. It was then that they opted to sell out a majority stake to Tata Group-owned Trent Ltd. with the understanding that Ramaiah would hold on to her 24 per cent stake over the next three years and help smoothen the transition. At the end of this tenure, Ramaiah made a complete exit by selling her stake in the company to Trent.

Ramaiah is presently managing director, shop4solutions, a retail consultancy firm that she runs with her husband. The duo also serves as venture advisors for TVS Capital Fund that focuses exclusively on the consumer retail space. Today, in her role as a consultant, Ramaiah plays mentor to entrepreneurs whose dreams are still young.

Time to let go

When we (my husband and I) reached the age of 42 – 43, our first thought was to grow the business dramatically and to look at bringing in private equity (PE). But our interactions with the PE players made us realise that there would come a point where the PE firm would exit and the founding team would obviously stay behind, only to begin the hunt again. At that age, this constant dilution of equity made little sense. Eventually, we had to look at making an exit and this meant a hunt for a strategic buyer who was interested in the space. We made a shortlist of three to four big retailers who were into other spaces such as hypermarkets and apparel retail and it finally came down to Trent.

An evaluation of the market was another decisive factor in our decision as it was difficult for us as an individual entity to fight the complexities of warehousing, imports and digitisation, while for a conglomerate it would be just another part of business. We felt it was better to sell at a time when the going was good rather than fight an uphill battle, five years later.

Personally, my husband and I debated about when we wanted to retire from this business and ultimately, we decided on a cut-off age of 50. Our goal was to put aside some money to pursue other ideas at our own pace. Also, at this time, our daughter was eight years old and I felt I was losing out on time spent with her. This was the second decisive factor that led to the exit.

While timing an exit, as an entrepreneur, you must look to balance the professional with the personal. While younger entrepreneurs would have the energy and opportunity to become serial entrepreneurs, a cut off age might be beneficial for an older person.

Choosing Trent

The culture of the buyer was extremely important. The buyer’s approach to the buyout, entrepreneur, transition phase and growth were the most important factors for consideration. With Trent, it made logical sense because they were in all the malls that we were at and we shared a common client base. And most importantly, the Tata brand legacy gave us the confidence that Trent would be able to sustain the business despite stiff competition and market vagaries.

It is advisable for you, the entrepreneur, to make a shortlist of buyers who are a ‘best fit’ rather than wait for your investment banker to come up with a list. This way, you can gauge the buyer’s interest level in growing the business rather than looking at just the selling price.

Staying the three years

From an entrepreneur’s point of view, making a clean break from a business is always desirable, but in most cases the entrepreneur also feels the need to educate the new buyer on his/her business philosophy. In my case, the transition period that was agreed upon was three years, after which I made my exit in 2008.

Try to negotiate a transition phase that is under 18 months, unless you and the new owner share a fabulous working equation which more often than not is a dream, not reality. To a conglomerate, your dream matters less so, be practical.

Focus on valuation

Whichever way you look at it, when it comes to valuation, you will arrive at one figure – give or take five per cent. Ours was a brick and mortar business, so were realistic about the sale price as this is not a space where a buyer would pay irrational amounts.

You must be real about the space you are in when it comes to valuing your business. You cannot base your expectations on other industries and hold on to an unrealistic target. At the end of the day, the buyer also has to see a way to make money through your business.

What next?

At the time that we sold, one day I was at work at 10: 30 a.m. and the next day, I was out of a job. After 32 years, that was a very strange feeling. We had already bought our current office premises and I looked at it as a place that I could go to, away from home to keep my routine going. Just a few months before we sold Landmark to Trent, TVS Capital Fund had approached us to join them and post the exit, it seemed like a great opportunity to join them as venture advisors to use our experience and play the intermediary role between entrepreneurs and investors. We had been on both sides and we wanted to actually “listen” to the entrepreneur while breaking the myth of the investor being a “devil” in disguise. I’m also very excited about working with young entrepreneurs in the consumer retail space and I’m fascinated by the way they think. It helps me keep my brain alive!

Only you can determine what’s next for you. Some entrepreneurs plan the next phase well in advance; some take it as it comes.

Future of books

For all entrepreneurs, the aim is to stay ahead of the markets. In this particular space, the future lies in digitisation. While we were in Landmark, we lacked the know-how to get there, but for those still in the space that is where the money is. Even though India lags behind the West, digitisation is catching up and the pace can surprise a few players.

If you are going to stay in the same industry or are thinking of starting a new venture, think and stay ahead by being aware of the next best thing in that space.