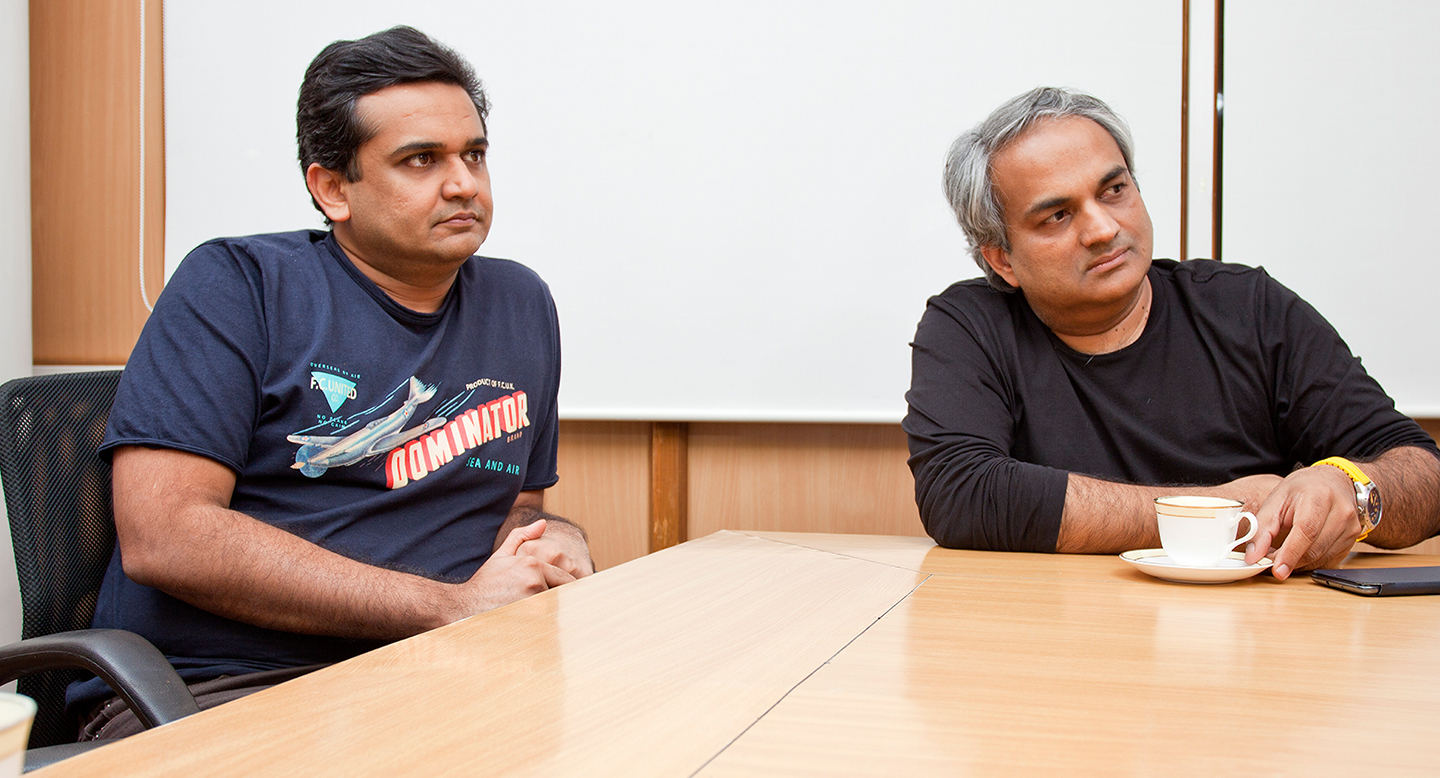

Indian entrepreneurs Alok Kejriwal and Mahesh Murthy never shy away from speaking their minds. Here, we get them to analyse hard-hitting aspects of the Indian startup ecosystem and gather practical tips for early-stage entrepreneurs

Alok Kejriwal calls himself ‘Rodinhood’ on the Internet. He says the name, Rodinhood, is inspired by The Thinker, a sculpture designed by Frenchman Auguste Rodin, and Robin Hood, the doer. His tagline on his personal blog reads ‘In karma, I trust’. This karma, I guess, played a crucial role in Kejriwal’s life when, in 1998, he decided to reinvent himself and transition from working for his father’s socks manufacturing business to becoming a digital entrepreneur by founding a series of Internet companies – Contest2Win.com, Mobile2Win.com, Media2Win.com and now, Games2Win.com (Mobile2Win.com was acquired by Walt Disney Animation Studios in China and Norwest Venture Partners in India).

The journey of Mahesh Murthy is probably just as karma-fied. A college dropout (which lends Silicon Valley-style credibility to his career), Murthy made a mark in the world of advertising in the U.S. before he returned to India to head Channel V until its sale to Newscorp, Rupert Murdoch’s multinational media conglomerate. Since then, he has invested in numerous startups as an angel investor and currently runs Seedfund, a fund focused on investing in highly differentiated early-stage businesses in India. More recently, Murthy has been known for betting on Carwale.com and Redbus.in, two Internet startups that have made a mark and grown almost entirely on word-of-mouth commendation.

Both Murthy and Kejriwal have been early members and an integral part of the Indian startup ecosystem that is inspired by Silicon Valley. Both of them care less about capital-intensive debt-heavy industries. They love the web, the world of technology and new age businesses, the concept of completely differentiating the fundamental mission of a company and building a personal brand.

They are, in some sense, influencers whose Facebook and Twitter feeds, blog posts and opinionated quotes in the media draw a lot of attention. Borrowing a quote from a 1980s Apple advertisement, ‘You can hate them, but you cannot ignore them’ seems to be a mantra both these guys swear by and it is for this reason that, at The Smart CEO, we decided to feature them on the cover and gather as many hard-hitting opinions as possible by bringing them together for a brainstorming session.

Last month, the three of us gathered at the Games2Win office in Tardeo, Mumbai. The idea was that I would moderate the discussion if things went out of hand. It did, but I couldn’t control the free flow of thoughts either. Murthy and Kejriwal, in their inimitable, dynamic styles rattled on. The conversation that followed was loaded with deep insights and strong opinions. It certainly was an experience worth chronicling.

As we go along in this conversation, we discuss several aspects of the Indian startup ecosystem – the role of copycat innovation, why Indian investors would never have invested in ideas like Facebook or Twitter and why the Amazon.com of India is Amazon.com (though, personally, I don’t agree with this viewpoint). We also gather some useful tips on other aspects of running a business like the strategy behind quality customer service, hiring and pricing a new product or service.

TALKING THE TALK AND WALKING THE WALK

The Smart CEO (TSC): Several ideas that get funded today are copies of similar concepts in the U.S. Will copycat innovation work in India, like it works in China?

Mahesh Murthy (MM): Now, this copycat thing, how is this innovation?

Alok Kejriwal (AK): Yes, it’s a paradox. But let me narrate a story from a panel discussion I was part of a while ago. One venture capital (VC) on the panel mentioned that money is chasing proven models. According to the VC, if it works in the U.S., then there is a very good chance it’ll work in India – we just need to ensure the entrepreneur can execute well on that model. While I’m not too kicked about copycats, it does seem like venture money is chasing such ideas.

MM: It (investing in copycats) is certainly not my way. The market here is very different. The problem that Amazon solved in the U.S. is very different from the problem that Amazon needs to solve in India. The problem that Kelly Blue Book (an online portal to check the resale value of used cars) solved in the U.S. is not what Carwale solved in India. The problem Redbus (a business that sells bus tickets to consumers) is trying to solve, no one else in the world has tried to solve. The market, the products, the consumers, the problems are different; the solutions are likely to be different. I haven’t seen copy-paste work in India. Future Group is trying to be the Walmart of India, but if you look a little deeper and analyse the rentals it pays, you will realise how the model has to be different to make retail work here.

AK: At Games2Win, we tried to mimic MMOGs (massively multiplayer online games) in India. We realised very quickly that it wasn’t working. However, in China, Mobile2Win did really well after Disney bought us out. The offering was good and once the Disney brand was added to Mobile2Win, paying customers started coming in. Fundamentally, China and India are very different. Shanda games’ business works in China because it convinced the Ministry of Culture and Information that all other games that don’t have Chinese characters and dragons are not good for a Chinese audience.

MM: The reason copycats work in China is because everything online is preferred in the Chinese language there. Baidu is China’s Google because it is in Chinese. In India, English is the language online. So, the Yahoo of India will be Yahoo, the Google of India will be Google and the Amazon of India will be Amazon. And chances are we can’t win by taking on those companies. Very rarely does one see an exit like Bazee.com, which got bought over by eBay. Overall, I am convinced that copycats don’t work.

TSC: At a broad level, we think there are two categories of entrepreneurs in India. One category is focused on building non-capital intensive, innovation-driven businesses by raising money from venture investors. The other category raises a lot of debt, along with equity, and is going after bigger plays – for example, building power plants or setting up large scale manufacturing facilities. My understanding is that the second category thinks really big. What can one category learn from the other?

MM: Of course, we’ve the Ambanis and the Adanis, who’re putting their bets on billion-dollar businesses. But they work in sectors that can be collateralised, so debt is available. In areas venture capitalists’ work in, the primary assets, usually, are human capital and intellectual property. In general, as a VC, I am interested in working with an entrepreneur for four to five years and help him build his business. I am not interested in owning his business.

I don’t want to work in sectors where we need to manage the government, wade through a string of regulations and resort to corrupt means. For me, it is certainly not about how rich you are; it is all about how well you can sleep at night. I don’t think the two categories can learn much from each other. This whole concept of best practices from one sector applied to another just doesn’t make any sense to me. You can’t compare an Apple with a Walmart. The only common point is that entrepreneurs need to think big and who said you can’t think big in a non-capital intensive category?

AK: My perspective here is very different. I ran a factory with my father for nine years. I hated it. Why should I learn something from people I don’t want to emulate? In fact, for me, I had to unlearn a lot after being in a family business setting. How many family businesses are ready to part with equity? I think you are confusing two very different sets (of businesses).

TSC: Is the Indian venture capital world too focused on technology-themed investments?

MM: At Seedfund, we’ve invested in several non-technology ideas. Vaatsalya is a healthcare play in Tier-II cities. EduSports focuses on sports education in schools and ThinkLabs is betting on practical ‘learning by doing’ for school and college children. We’re going after building consumer businesses where we can grow through word-of-mouth and not through huge marketing spends.

AK: I’m allergic to anything non-technology. I come from the non-technology world and have a big ghost of a factory behind me. I don’t even want to go there.

TSC: Who are your role models?

AK: All the founders of global technology companies are role models. Even today, Jerry Yang of Yahoo is a role model. Larry Page, the founders of Facebook and several other Silicon Valley entrepreneurs are role models. Some financiers are role models. Sean Parker, who bet on Facebook, is right up there. Marc Pincus of Zynga demystified the idea that you need to be passionate about gaming to invest in gaming. I can name 20 such people, maybe more. For me, it is all from the technology world; so let me tell you, someone like Gandhi is not a role model.

MM: There are several people I admire. I don’t know whether they are role models or whether I want to be like them. When I was young, I was a huge fan of Ayn Rand, Richard Feynman and Albert Einstein – these are all people I admire. I’ve had several mentors – people I worked with – whom I’ve learnt from and respected. These are people who stand up for what they believe in; they didn’t cave in to anything and were unreasonable.

AK: That reminds me of a story. Once, Sumant Mandal from Clearstone Venture Partners told me: “Alok, you agree too much. We know nothing about your business but we seem to hear more yeses than nos.” The biggest success stories are always from entrepreneurs who want to run away, do their own thing and then turn their ventures into a PayPal or a YouTube.

MM: Yes, I agree. Stop listening to people. Don’t listen to Alok. Don’t listen to Mahesh.

TSC: Would Indian VCs invest in ideas like Facebook or Twitter that didn’t have a clear revenue model in place when they were raising money?

MM: I think there are two questions we need to discuss here. One, would Indian VCs invest in a business that wouldn’t make any money for three years and two, can we spot a world-changing company that can be built out of India? My personal philosophy on investing is that when I give a company money, by the time the cash runs out, the company should break-even on a cash flow basis.

AK: I question that philosophy. I’m 43 years old; I’m waiting for my big moment under the sun. I’m trying to build a US $100 million gaming business out of India. Making a dent is what I’m going after. I guess it is two different mindsets – one is building a business around P&L (profit and loss) and the other is building a balance sheet business (one which is a valuation-driven business, which can be sold to some strategic investor). When we sold Mobile2Win to Disney China, the company made no money. Yet, once the company came under the Disney brand, customers were willing to pay. This is an example of a valuation-driven business model, where a company buys another’s balance sheet and converts it into P&L.

MM: In the U.S., venture investors do understand that five or six startups will shutdown. They’re looking for that one superstar. However, I don’t have the cavalier mentality to say half my children will die. As an investor, the first call I make is – if I invest here, can I make the money back? I’d prefer a Rahul Dravid, someone who can bat consistently, rather than a Virender Sehwag, who’ll fail five times and then get a triple hundred the sixth time.

AK: I certainly prefer the swashbuckling Sehwag-style.

MM: In the West, the venture capital business is over 40 years old. In India, right now we’ll discipline a Sehwag to become a Sachin Tendulkar or spice-up a Dravid to become a Tendulkar. A few years from now, we’ll certainly see more investments in Silicon Valley style companies but it’s too early now. Let us, as VCs, first prove that money can be made out of India.

TSC: Why do you guys think the Amazon of India is going to be Amazon? Why not Flipkart?

MM: My perspective is businesses, fundamentally, need to make money! Your business is fundamentally losing money and you’re funding your losses through venture capital money. You have a spoilt customer. Your only exit option is going to be in NASDAQ. Your website should drive traffic because of your offering, not because of TV ads. Of course, Flipkart is playing the valuation game – the hit big, get big fast strategy. But in my mind, the fundamentals of a business have to be stronger.

TSC: But this doesn’t answer why Amazon will be the Amazon of India?

AK: Amazon will win simply because of its 12 years of e-commerce experience of selling to consumers and doing a brilliant job at it. It’s not going to evaporate.

MM: I agree.

FOUNDER SPEAK: THE ART OF BEING UNREASONABLE

TSC: What should the day-to-day responsibility of a founder be?

MM: The most critical role is to play the role of a human resources person and keep your team charged up. The second is to be the face of the company for a customer. A founder has to be unreasonable, if something has to be done in three days, it has to be done – you need to get your team to follow your drive and vision.

AK: One big skill entrepreneurs need to pick up is the ability to maintain relationships with the VC world. You need to learn to work with your board. These two categories – investors and entrepreneurs – were never supposed to work together, sometimes you are going after the same thing and sometimes you are not. Managing this relationship is crucial.

In some cases, founders don’t know how to manage themselves outside the company. Founders need to make decisions actively. One should have the courage to go to the board and say, ‘Boss, I messed up and we need to change this business model.’ Like Mahesh says, one needs to have the courage to be unreasonable.

MM: Going back to the founder as a HR person, it’s important that an entrepreneur plays a hands-on role while recruiting people. You need to hire people who can take action, based on ambiguous directions. Entrepreneurs don’t have time to be super-direct with their employees. Such employees who need day-to-day help and handholding won’t work well for a startup.

TSC: Would you advise putting together an advisory board for your startup? How do you compensate your advisory board?

MM: One should certainly have mentors.

AK: Absolutely. You’re obviously not an expert at everything.

MM: Maybe, it depends on who you are. If you’re an entrepreneur, who has already sold a startup or two, then you don’t need an advisory board. Advisory board member compensation is standard – 0.25 to 0.5 per cent of your company in stock.

TSC: Tony Hsieh, the CEO of Zappos, an online retailer of shoes that was acquired by Amazon, wrote this book titled ‘Delivering Happiness’ and called for a customer service strategy as a differentiator for your company. Does this make sense in an Indian context? Aren’t Indian consumers more price-sensitive than service-sensitive?

AK: Look at Flipkart.com. You get an SMS; you get your product on time. They have certainly done all the right things in terms of customer service. Look at what Jubilant Foodworks has done with Dominos Pizza.

MM: My perspective is a little different here. Eventually, several players will have good customer service. Indian retailers are traditionally good at getting their back-end right. It is the front-end that has to be differentiated. Can we get good designers to wow customers at the front-end? Can the customer experience, through user-interface design and features, be so differentiated that people love coming back to your website?

AK: Let’s discuss a non-web-based company. Look at Indigo Airlines. Except for its crappy advertisement, as a customer, you get great value, great service. But maybe, going forward, customer service might just be the minimum you can do for a customer.

TSC: What should be the pricing strategy for your product or service?

MM: In the absence of a brand, your pricing drives your brand. I always advise entrepreneurs to price at a premium. In one of my earlier portfolio companies, Geodesic, we out-priced Yahoo’s price for a search engine marketing, offering 2:1. Yet, we won the contract. As long as you have the feature sets and the offering to command a premium, do it. It will reposition your brand as premium. I mean, look at what Steve Jobs did. He priced his products at a super premium and look at what’s happening.

AK: I think it’s also important to look at your company’s ecosystem to see what is happening in terms of price. For example, if you’re making money through online advertising, there is a typical price range for CPMs (cost per million impressions). In general, I look at a cost-plus (cost-based) pricing most of the time. It’s the Marwari attitude, boss!

TSC: Should you give away stock options to all your employees?

AK: I think you should give it to people who’ll treasure them. I’d suggest waiting till someone has stayed with the company for a year and then give away options. I don’t think you should give it to employees, who don’t understand what options are.

MM: While I was in the U.S., I was this junior guy from India who was given options. I liked the way I was treated. I think you should give everyone options – it conveys the message that you want to treat them well. The senior folks should certainly have options, set aside 5 per cent to 10 per cent of your company for your most critical employees.

As I get ready to ask my final question (it’s a question we ask everyone we meet: final word of advice to early-stage entrepreneurs), Kejriwal reminded us that we had over shot by 30 minutes. He didn’t stop there; he got up and declared the meeting over. I didn’t prod further. I thought the two-hour discussion was as relevant as I had ever had with seasoned entrepreneurs. We quickly wound up after wrapping up the photo shoot for the cover in less than five minutes. With Murthy and Kejriwal, it’s always informal, quick and to the point. For early-stage entrepreneurs, I leave you with an answer to the final question that went unanswered – Think Different, yet another Apple tagline that every entrepreneur should swear by.

MAHESH MURTHY, FOUNDING PARTNER, SEEDFUND

INTERESTING TIT BIT: After dropping out of college, Murthy sold vacuum cleaners door-to-door.

CURRENT AVATAR: Nurtures and mentors entrepreneurs Invests in early-stage companies at Seedfund Runs Pinstorm, a digital marketing ad agency

PAST AVATAR: Advertising man, worked with Grey in India, Ogilvy in Hong Kong and CSK Partners in the U.S. Then became the head of Channel V in India.

BRAGGING RIGHTS: Worked on the earth’s biggest bookstore campaign for Amazon.com and helped launch the first commercial version of Yahoo.com

COMMUNICATION STYLE: Soft, to-the-point, yet strong opinions

FAMOUS FOR: His views on Indian e-commerce valuations and investments in Carwale.com and Redbus.in

ALOK KEJRIWAL, SERIAL ENTREPRENEUR, CO-FOUNDER, CONTEST2WIN

INTERESTING TIT BIT: Quoted “Money is, literally, the gravy that makes life tasty for a Marwari” in an interview which appeared on Live Mint, a newspaper.

CURRENT AVATAR: Runs Games2win.com Passionate about the technology world Swears by Silicon Valley success stories, hates factories

PAST AVATAR: Worked for his father in a socks manufacturing company, Hindustan Hosiery Industries

BRAGGING RIGHTS: Built Mobile2win and sold it to Walt Disney Animation Studios, China.

COMMUNICATION STYLE: Informal, aggressive approach. Speaks his mind. Loves slogan-dropping in Hindi, even if people don’t understand what he’s saying!

FAMOUS FOR: His blog Roddinhood.com is a must-read for early-stage entrepreneurs.